Question: Please show work! I'll give a thumbs up if right!! thanks :) A 10-year, 11.00%, $5,000 bond that pays dividends quarterly can be purchased for

Please show work! I'll give a thumbs up if right!! thanks :)

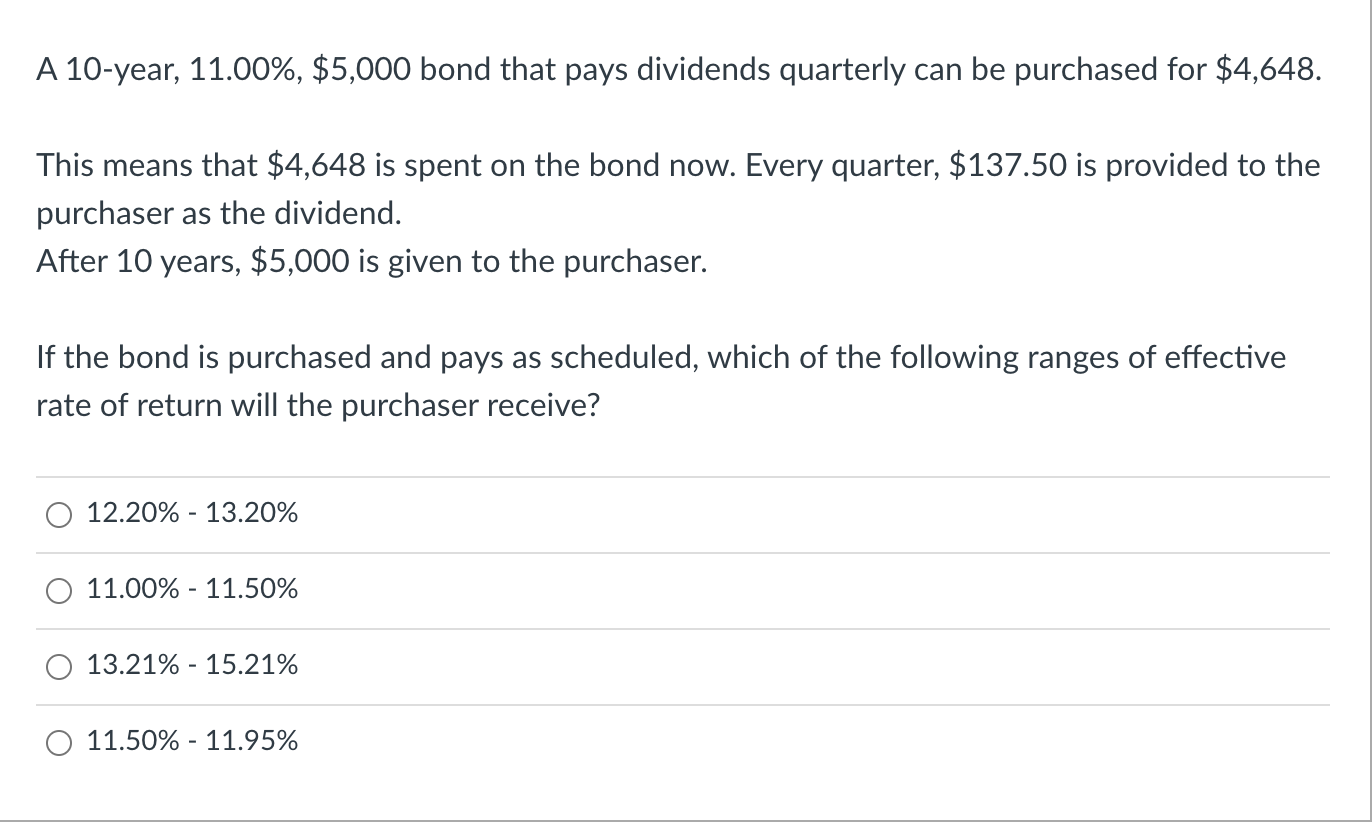

A 10-year, 11.00%, $5,000 bond that pays dividends quarterly can be purchased for $4,648. This means that $4,648 is spent on the bond now. Every quarter, $137.50 is provided to the purchaser as the dividend. After 10 years, $5,000 is given to the purchaser. If the bond is purchased and pays as scheduled, which of the following ranges of effective rate of return will the purchaser receive? 12.20% - 13.20% 11.00% - 11.50% 13.21% - 15.21% 11.50% - 11.95%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock