Question: Please show work in Excel. 1. Suppose you are looking to buy a 4.5% Callable Corporate Bond today (settle is 04/27/2021). The price is quoted

Please show work in Excel.

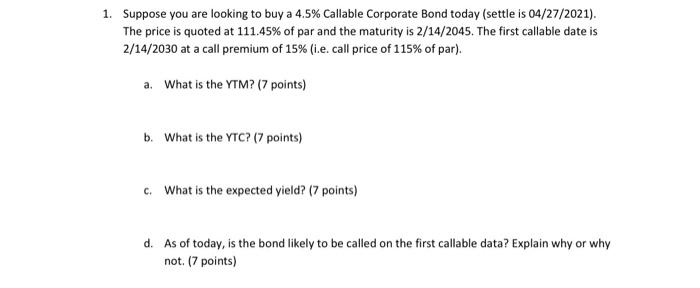

Please show work in Excel. 1. Suppose you are looking to buy a 4.5% Callable Corporate Bond today (settle is 04/27/2021). The price is quoted at 111.45% of par and the maturity is 2/14/2045. The first callable date is 2/14/2030 at a call premium of 15% (.e. call price of 115% of par). a. What is the YTM? (7 points) b. What is the YTC? (7 points) c. What is the expected yield? (7 points) d. As of today, is the bond likely to be called on the first callable data? Explain why or why not. (7 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock