Question: Please show work in excel. E7-7 (Recording Bad Debts) Duncan Company reports the following financial information before adjustments. Dr. Cr. $100,000 Accounts Receivable Allowance for

Please show work in excel.

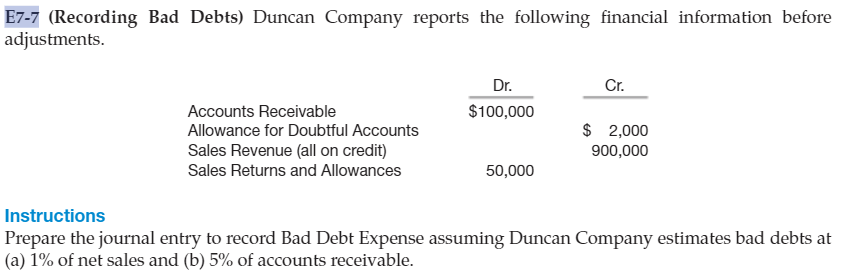

E7-7 (Recording Bad Debts) Duncan Company reports the following financial information before adjustments. Dr. Cr. $100,000 Accounts Receivable Allowance for Doubtful Accounts 2,000 Sales Revenue (all on credit) 900,000 Sales Returns and Allowances 50,000 Instructions Prepare the journal entry to record Bad Debt Expense assuming Duncan Company estimates bad debts at (a) 1% of net sales and (b) 5% of accounts receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts