Question: PLEASE SHOW WORK IN EXCEL - I HAVE BEEN STRUGGLING WITH THIS ALL DAY You are considering constructing a new plant in a remote wilderness

PLEASE SHOW WORK IN EXCEL - I HAVE BEEN STRUGGLING WITH THIS ALL DAY

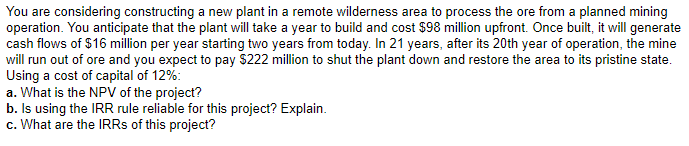

You are considering constructing a new plant in a remote wilderness area to process the ore from a planned mining operation. You anticipate that the plant will take a year to build and cost $98 million upfront. Once built, it will generate cash flows of $16 million per year starting two years from today. In 21 years, after its 20 th year of operation, the mine will run out of ore and you expect to pay $222 million to shut the plant down and restore the area to its pristine state. Using a cost of capital of 12% : a. What is the NPV of the project? b. Is using the IRR rule reliable for this project? Explain. c. What are the IRRs of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts