Question: Please show work in excel with formulas Problem 5 Calculate the duration, in years, of a bond that matures in 10 years, pays $20 in

Please show work in excel with formulas

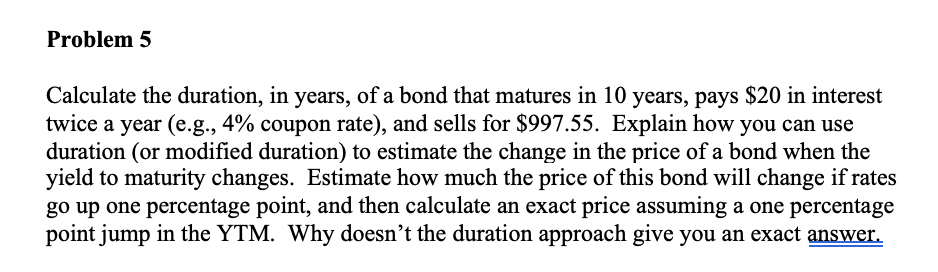

Problem 5 Calculate the duration, in years, of a bond that matures in 10 years, pays $20 in interest twice a year (e.g., 4% coupon rate), and sells for $997.55. Explain how you can use duration (or modified duration) to estimate the change in the price of a bond when the yield to maturity changes. Estimate how much the price of this bond will change if rates go up one percentage point, and then calculate an exact price assuming a one percentage point jump in the YTM. Why doesn't the duration approach give you an exact

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts