Question: Please show work :) In Excel would be awesome, too. 17. Interpreting results from the Du Pont system of analysis (LO3-3 @ ) Assume the

Please show work :) In Excel would be awesome, too.

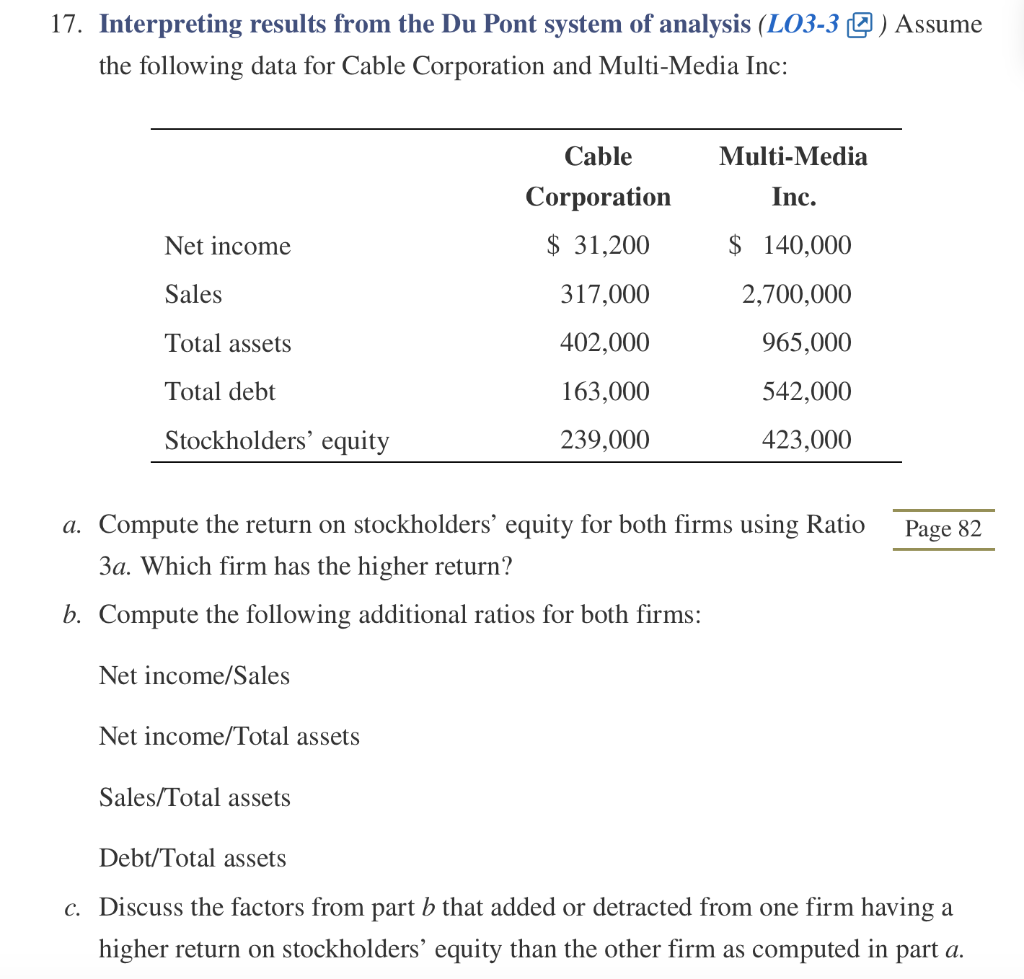

17. Interpreting results from the Du Pont system of analysis (LO3-3 @ ) Assume the following data for Cable Corporation and Multi-Media Inc: Cable Multi-Media Inc. Corporation $ 31,200 Net income $ 140,000 Sales 317,000 2,700,000 Total assets 402,000 965,000 Total debt 163,000 542,000 Stockholders' equity 239,000 423,000 Page 82 a. Compute the return on stockholders' equity for both firms using Ratio 3a. Which firm has the higher return? b. Compute the following additional ratios for both firms: Net income/Sales Net income/Total assets Sales/Total assets Debt/Total assets c. Discuss the factors from part b that added or detracted from one firm having a higher return on stockholders' equity than the other firm as computed in part a. 17. Interpreting results from the Du Pont system of analysis (LO3-3 @ ) Assume the following data for Cable Corporation and Multi-Media Inc: Cable Multi-Media Inc. Corporation $ 31,200 Net income $ 140,000 Sales 317,000 2,700,000 Total assets 402,000 965,000 Total debt 163,000 542,000 Stockholders' equity 239,000 423,000 Page 82 a. Compute the return on stockholders' equity for both firms using Ratio 3a. Which firm has the higher return? b. Compute the following additional ratios for both firms: Net income/Sales Net income/Total assets Sales/Total assets Debt/Total assets c. Discuss the factors from part b that added or detracted from one firm having a higher return on stockholders' equity than the other firm as computed in part a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts