Question: Please show work Machine #2356 is 4 years old. When purchased it cost $65,000. SL. depr with zero salvage and a 5 year life has

Please show work

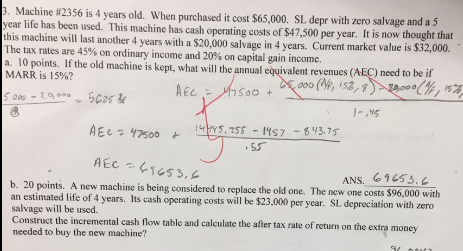

Machine #2356 is 4 years old. When purchased it cost $65,000. SL. depr with zero salvage and a 5 year life has been used. This machine has cash operating costs of $47, 500 per year. It is now thought that this machine will last another 4 years with a $20,000 salvage in 4 years. Current market value is $32,000. The tax rates are 45% on ordinary income and 20% on capital gain income. If the old machine is kept, what will the annual equivalent revenues (AEC) need to be if MARR is 15%? A new machine is being considered to replace the old one. The new one costs $96,000 with an estimated life of 4 years. Its cash operating costs will be $23,000 per year. SL depreciation with zero salvage will be used. Construct the incremental cash flow table and calculate the after tax rate of return on the extra money needed to buy the new machine? Machine #2356 is 4 years old. When purchased it cost $65,000. SL. depr with zero salvage and a 5 year life has been used. This machine has cash operating costs of $47, 500 per year. It is now thought that this machine will last another 4 years with a $20,000 salvage in 4 years. Current market value is $32,000. The tax rates are 45% on ordinary income and 20% on capital gain income. If the old machine is kept, what will the annual equivalent revenues (AEC) need to be if MARR is 15%? A new machine is being considered to replace the old one. The new one costs $96,000 with an estimated life of 4 years. Its cash operating costs will be $23,000 per year. SL depreciation with zero salvage will be used. Construct the incremental cash flow table and calculate the after tax rate of return on the extra money needed to buy the new machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts