Question: Please show work (Microsoft has an expected growth rate in earnings of 24% for the next five years.) A. Estimate the cost of equity using

Please show work

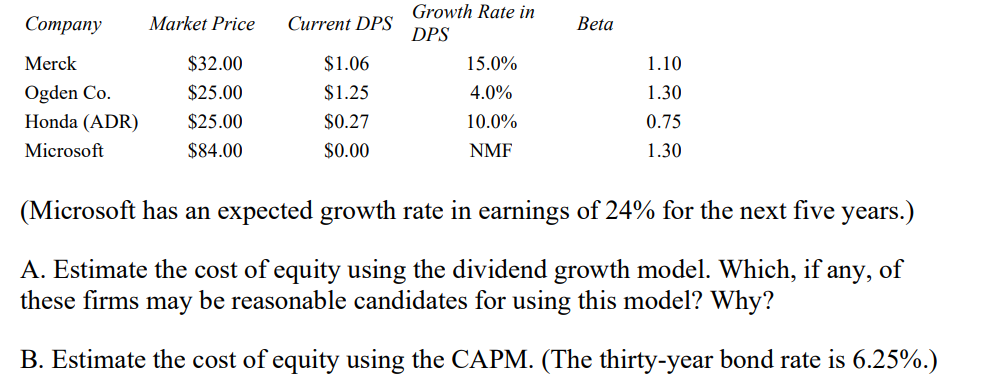

(Microsoft has an expected growth rate in earnings of 24% for the next five years.) A. Estimate the cost of equity using the dividend growth model. Which, if any, of these firms may be reasonable candidates for using this model? Why? B. Estimate the cost of equity using the CAPM. (The thirty-year bond rate is 6.25%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts