Question: Please show work Multiple Choice Question 46 Vaughn Manufacturing issued $6240000 of 996, ten-year convertible bonds on July 1, 2017 at 96.1 plus accrued interest.

Please show work

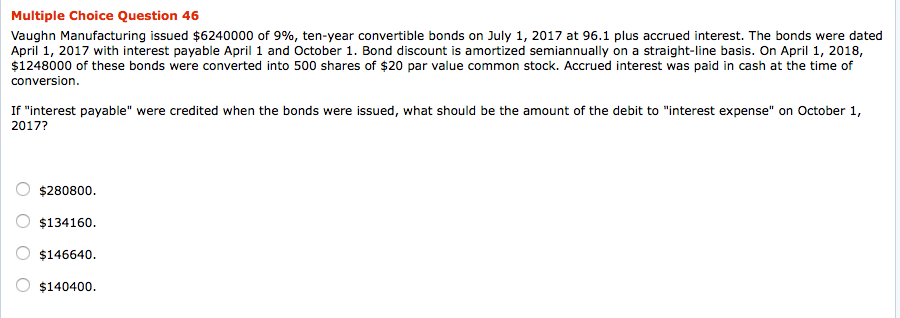

Multiple Choice Question 46 Vaughn Manufacturing issued $6240000 of 996, ten-year convertible bonds on July 1, 2017 at 96.1 plus accrued interest. The bonds were dated April 1, 2017 with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line basis. On April 1, 2018, $1248000 of these bonds were converted into 500 shares of $20 par value common stock. Accrued interest was paid in cash at the time of conversion If "interest payable" were credited when the bonds were issued, what should be the amount of the debit to "interest expense" on October 1, 2017? $280800 $134160. O $146640 $140400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts