Question: Please show work- no excel You are considering a portfolio of two stocks: X and Y. Stock X has an expected return of 12% and

Please show work- no excel

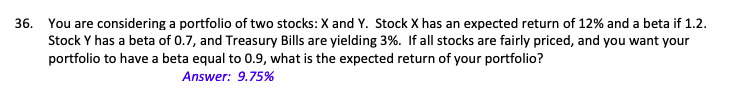

You are considering a portfolio of two stocks: X and Y. Stock X has an expected return of 12% and a beta if 1 2. Stock Y has a beta of 0.7, and Treasury Bills are yielding 3%. If all stocks are fairly priced, and you want your portfolio to have a beta equal to 0.9, what is the expected return of your portfolio? 36. Answer: 9.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts