Question: **Please show work. Not sure why I'm getting the wrong answer** Starset Machine Shop is considering a 4-year project to improve its production efficiency. Buying

**Please show work. Not sure why I'm getting the wrong answer**

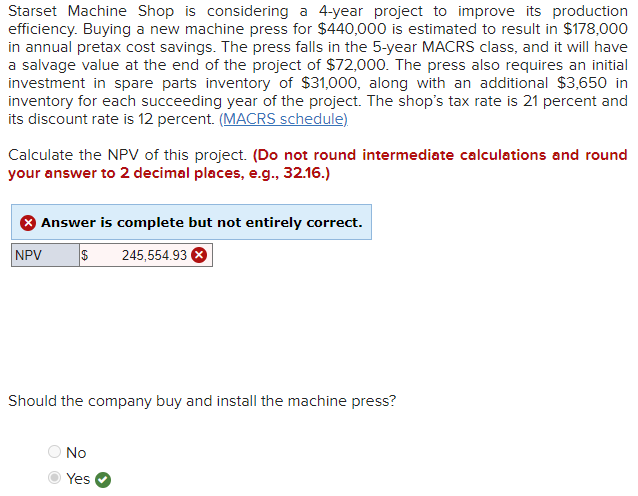

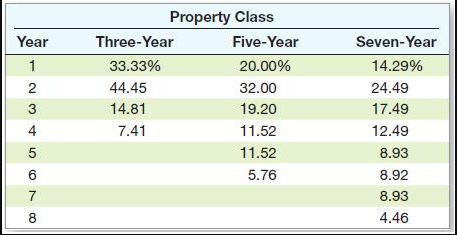

Starset Machine Shop is considering a 4-year project to improve its production efficiency. Buying a new machine press for $440,000 is estimated to result in $178,000 in annual pretax cost savings. The press falls in the 5-year MACRS class, and it will have a salvage value at the end of the project of $72,000. The press also requires an initial investment in spare parts inventory of $31,000, along with an additional $3,650 in inventory for each succeeding year of the project. The shop's tax rate is 21 percent and its discount rate is 12 percent. (MACRS schedule). Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. NPV 245,554.93 Should the company buy and install the machine press? No Yes Year 1 ovo AWN Property Class Three-Year Five-Year 33.33% 20.00% 44.45 32.00 14.81 19.20 7.41 11.52 11.52 5.76 Seven-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts