Question: please show work o Autosa Ch 19 Excel (1) - Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Tell me

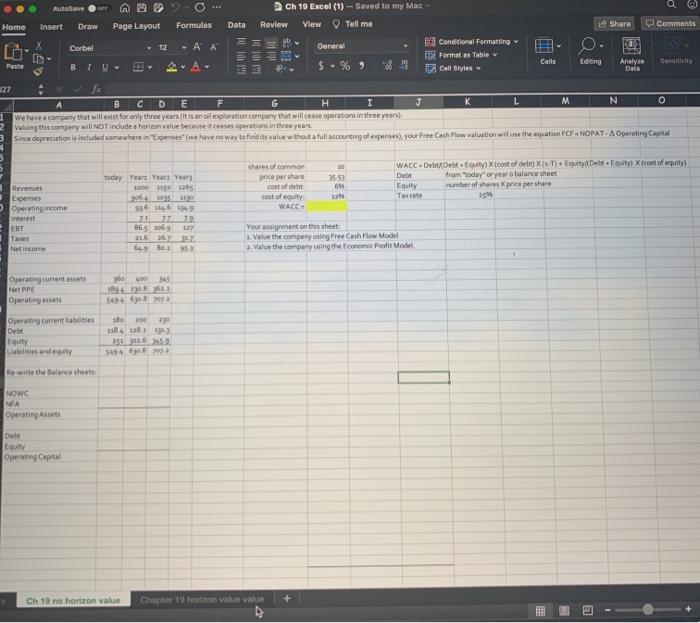

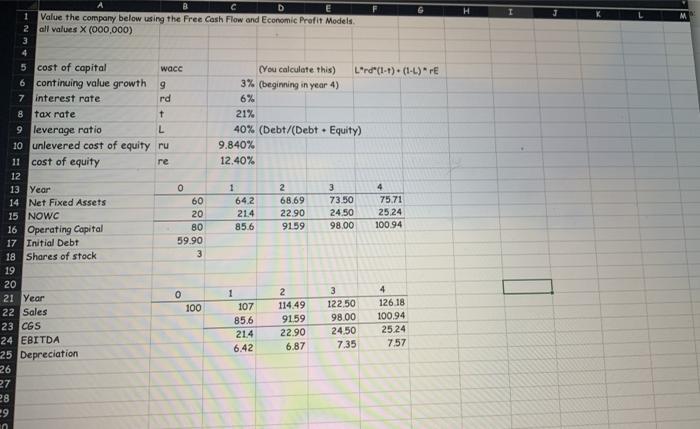

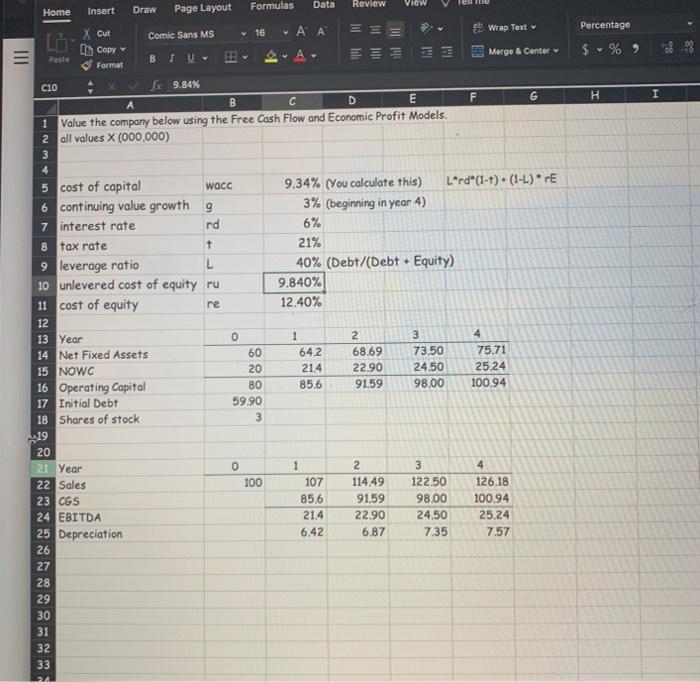

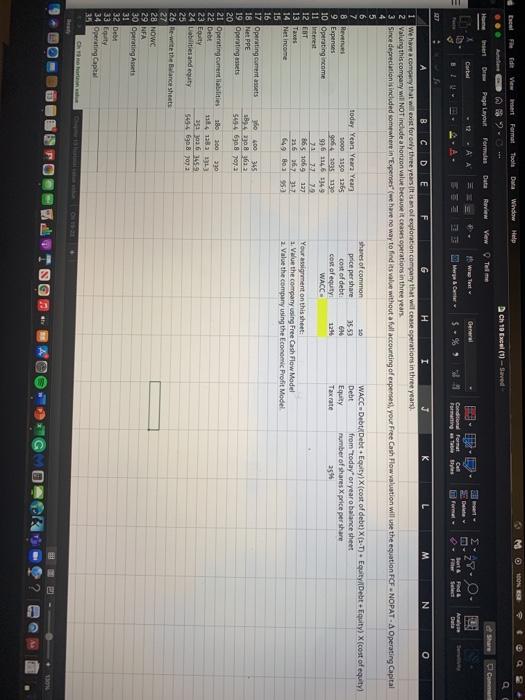

o Autosa Ch 19 Excel (1) - Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Corbel 12 Conditional Formatting General Format Table Paste BIU A- Cells Editing Analyze $% Call Styles Data 127 B C D E F G H K L M N 0 1 We have a company that will exist for only three years it is an oil exploration compary that will cease operations in three years) 2 Valuing this company will NOT include a horizon value because it eases operations in three year Since depreciation is included somewhere in Expenses we have no way to find its value without a full accounting of expenses your Free Cash Flow valuation will use the equation ICF NOPATA Operating Capital 10 35.53 WACC.Dettet. EquityX(cont of det XT. Equity Debt Equity Xcost of equity Debt from today or year o balance sheet Equity number of shares Xpricepershare 259 Reverse Experies Operating income erest ERT shares of common price perche cost of it cost of uity WACC- Today Yar Yar Year 1000 115 Us 30641095 93161 737 7.9 86.5 169 Your assigment on this sheet the companying Free Cash Flow Model 2. Valus the company using the Economic Profit Model Neincome 643 Operating contents Net PPE Operating sets yo 400 345 189 4330 5494 yos Operating current liabilities Debt Equity abilities and to 100 23 138 131313 35136 3416 Rewrite the balance sheets NOWC NA Operating Asset Det Equity Operating Capital + Ch 10 no horizon value Chapter 19 horizon vain value E H I K G D E Value the company below using the Free Cash Flow and Economic Profit Models. 2 all values X (000,000) (You calculate this) Lord"(1-1). (1-L)rE 3% (beginning in year 4) 6% 21% 40% (Debt/(Debt - Equity) 9.840% 12.40% 4 1 642 21.4 85.6 2 68.69 22.90 91.59 3 73.50 24.50 98,00 75.71 25.24 100.94 5 cost of capital wacc 6 continuing value growth 9 7 interest rate rd 8 tax rate t 9 leverage ratio L 10 unlevered cost of equity ru 11 cost of equity re 12 13 Year 0 14 Net Fixed Assets 60 15 NOWC 20 16 Operating Capital 80 17 Initial Debt 59.90 18 Shares of stock 3 19 20 21 Year 0 100 22 Sales 23 CGS 24 EBITDA 25 Depreciation 26 27 28 19 in 1 107 85.6 214 6.42 2 114.49 9159 22.90 6.87 3 122.50 98.00 24,50 7.35 4 126.18 100.94 25.24 7.57 Formulas View Insert Draw Data Review Tenue Home Page Layout X Cut Percentage == Wrap Text 16 Comic Sans MS Lo in copy lilli 28.08 19 = $ % Merge & Center Fale B TV Format H I clo fx 9.84% B D E F 6 1 Value the company below using the Free Cash Flow and Economic Profit Models. 2 all values X (000,000) 3 4 5 cost of capital wacc 9.34% (You calculate this) Lrd" (1-4). (1-L) rE 6 continuing value growth 9 3% (beginning in year 4) 7 interest rate rd 6% 8 tax rate 21% 9 leverage ratio L 40% (Debt/(Debt + Equity) 10 unlevered cost of equity ru 9.840% 11 cost of equity re 12.40% 12 13 Year 0 1 2 3 4 14 Net Fixed Assets 60 642 68.69 73,50 75.71 15 NOWC 20 214 22.90 24.50 25.24 16 Operating Capital 80 85.6 91.59 98.00 100.94 17 Initial Debt 59.90 18 Shares of stock 3 19 20 21 Year 0 1 2 3 4 22 Sales 100 107 114.49 122.50 126,18 23 CGS 85.6 91.59 98.00 100.94 24 EBITDA 21.4 22.90 24.50 25.24 25 Depreciation 6.42 6.87 7.35 7.57 26 27 28 29 30 31 32 33 24 die Ves Forma Tool Dua Wide Help 10 ch 10 Excel (1) - Saved Hans ins Or Page Layout Row View Tele Com Cat Gear O: Die EL EE2Merger $ - % Condition formules Find Anale Farming sable eyes Se Data RT f A B C D E F H J . N O We have a company that will exist for only three years it is molexploration company that will cease operations in three years). Valuing this company will NOT include a horizon value because it cases operations in three years Since depreciation is included somewhere in "Expenses we have no way to find its value without a full accounting of expenses your Free Cash Flowvaluation will use the equation FCF - NOPAT- Operating capital 6 3553 today Years Yeara Year 1000 5150 1265 9064 1035 1130 996 1145 1349 shares of common price per share cost of debt: cost of equity WACC WACC Debt Debt Equity) X(cost of debt)X(X-T). Equity Debt: Equity) X(cost of equity Debt from today or year o balance sheet Equity number of shares Xpricepershare Taxate 255 64 1256 8 Heves 9 Expenses 10 Operating income 11 terest 12 EST 13 Taxes 14 Net Income 865 106 127 236 36.7332 649 803 953 Your assignment on this sheet: 1. Value the company using Free Cash Flow Model 2. Value the company using the Economic Profit Model 16 17 Operating commentats 400 345 18 Net PPE B) 19 Operatings 594 601 79.a 20 21 Operating current liabilities 18 100 230 22 Debt 134 135 13 23 Egy 352 36 59 24 Libilities and equity 5454 6 8 1072 25 26 He write the Blance sheets 27 28 NOWC 29 UFA 30 Operatings 31 32 Det 33 34 Operating Capital 35 o Autosa Ch 19 Excel (1) - Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Corbel 12 Conditional Formatting General Format Table Paste BIU A- Cells Editing Analyze $% Call Styles Data 127 B C D E F G H K L M N 0 1 We have a company that will exist for only three years it is an oil exploration compary that will cease operations in three years) 2 Valuing this company will NOT include a horizon value because it eases operations in three year Since depreciation is included somewhere in Expenses we have no way to find its value without a full accounting of expenses your Free Cash Flow valuation will use the equation ICF NOPATA Operating Capital 10 35.53 WACC.Dettet. EquityX(cont of det XT. Equity Debt Equity Xcost of equity Debt from today or year o balance sheet Equity number of shares Xpricepershare 259 Reverse Experies Operating income erest ERT shares of common price perche cost of it cost of uity WACC- Today Yar Yar Year 1000 115 Us 30641095 93161 737 7.9 86.5 169 Your assigment on this sheet the companying Free Cash Flow Model 2. Valus the company using the Economic Profit Model Neincome 643 Operating contents Net PPE Operating sets yo 400 345 189 4330 5494 yos Operating current liabilities Debt Equity abilities and to 100 23 138 131313 35136 3416 Rewrite the balance sheets NOWC NA Operating Asset Det Equity Operating Capital + Ch 10 no horizon value Chapter 19 horizon vain value E H I K G D E Value the company below using the Free Cash Flow and Economic Profit Models. 2 all values X (000,000) (You calculate this) Lord"(1-1). (1-L)rE 3% (beginning in year 4) 6% 21% 40% (Debt/(Debt - Equity) 9.840% 12.40% 4 1 642 21.4 85.6 2 68.69 22.90 91.59 3 73.50 24.50 98,00 75.71 25.24 100.94 5 cost of capital wacc 6 continuing value growth 9 7 interest rate rd 8 tax rate t 9 leverage ratio L 10 unlevered cost of equity ru 11 cost of equity re 12 13 Year 0 14 Net Fixed Assets 60 15 NOWC 20 16 Operating Capital 80 17 Initial Debt 59.90 18 Shares of stock 3 19 20 21 Year 0 100 22 Sales 23 CGS 24 EBITDA 25 Depreciation 26 27 28 19 in 1 107 85.6 214 6.42 2 114.49 9159 22.90 6.87 3 122.50 98.00 24,50 7.35 4 126.18 100.94 25.24 7.57 Formulas View Insert Draw Data Review Tenue Home Page Layout X Cut Percentage == Wrap Text 16 Comic Sans MS Lo in copy lilli 28.08 19 = $ % Merge & Center Fale B TV Format H I clo fx 9.84% B D E F 6 1 Value the company below using the Free Cash Flow and Economic Profit Models. 2 all values X (000,000) 3 4 5 cost of capital wacc 9.34% (You calculate this) Lrd" (1-4). (1-L) rE 6 continuing value growth 9 3% (beginning in year 4) 7 interest rate rd 6% 8 tax rate 21% 9 leverage ratio L 40% (Debt/(Debt + Equity) 10 unlevered cost of equity ru 9.840% 11 cost of equity re 12.40% 12 13 Year 0 1 2 3 4 14 Net Fixed Assets 60 642 68.69 73,50 75.71 15 NOWC 20 214 22.90 24.50 25.24 16 Operating Capital 80 85.6 91.59 98.00 100.94 17 Initial Debt 59.90 18 Shares of stock 3 19 20 21 Year 0 1 2 3 4 22 Sales 100 107 114.49 122.50 126,18 23 CGS 85.6 91.59 98.00 100.94 24 EBITDA 21.4 22.90 24.50 25.24 25 Depreciation 6.42 6.87 7.35 7.57 26 27 28 29 30 31 32 33 24 die Ves Forma Tool Dua Wide Help 10 ch 10 Excel (1) - Saved Hans ins Or Page Layout Row View Tele Com Cat Gear O: Die EL EE2Merger $ - % Condition formules Find Anale Farming sable eyes Se Data RT f A B C D E F H J . N O We have a company that will exist for only three years it is molexploration company that will cease operations in three years). Valuing this company will NOT include a horizon value because it cases operations in three years Since depreciation is included somewhere in "Expenses we have no way to find its value without a full accounting of expenses your Free Cash Flowvaluation will use the equation FCF - NOPAT- Operating capital 6 3553 today Years Yeara Year 1000 5150 1265 9064 1035 1130 996 1145 1349 shares of common price per share cost of debt: cost of equity WACC WACC Debt Debt Equity) X(cost of debt)X(X-T). Equity Debt: Equity) X(cost of equity Debt from today or year o balance sheet Equity number of shares Xpricepershare Taxate 255 64 1256 8 Heves 9 Expenses 10 Operating income 11 terest 12 EST 13 Taxes 14 Net Income 865 106 127 236 36.7332 649 803 953 Your assignment on this sheet: 1. Value the company using Free Cash Flow Model 2. Value the company using the Economic Profit Model 16 17 Operating commentats 400 345 18 Net PPE B) 19 Operatings 594 601 79.a 20 21 Operating current liabilities 18 100 230 22 Debt 134 135 13 23 Egy 352 36 59 24 Libilities and equity 5454 6 8 1072 25 26 He write the Blance sheets 27 28 NOWC 29 UFA 30 Operatings 31 32 Det 33 34 Operating Capital 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts