Question: please show work on Excel e 01 - Time Value of Money What is the present value of a five-year $25,000 ordinary annuity plus of

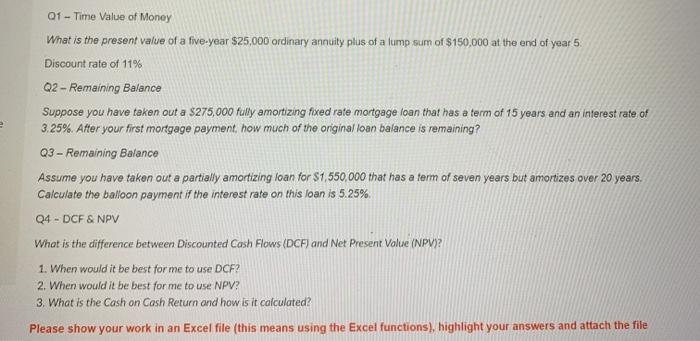

e 01 - Time Value of Money What is the present value of a five-year $25,000 ordinary annuity plus of a lump sum of $150,000 at the end of year 5. Discount rate of 11% Q2 - Remaining Balance Suppose you have taken out a $275,000 fully amortizing fixed rate mortgage loan that has a term of 15 years and an interest rate of 3.25%. After your first mortgage payment, how much of the original loan balance is remaining? Q3 - Remaining Balance Assume you have taken out a partially amortizing loan for $1,550,000 that has a term of seven years but amortizes over 20 years. Calculate the balloon payment if the interest rate on this loan is 5.25% Q4 - DCF & NPV What is the difference between Discounted Cash Flows (DCF) and Net Present Value (NPV)? 1. When would it be best for me to use DCF? 2. Wher would it be best for me to use NPV? 3. What is the Cash on Cash Return and how is it calculated? Please show your work in an Excel file (this means using the Excel functions), highlight your answers and attach the file

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts