Question: Please show work on excel Navin Co. is considering replacing an existing machine on its cheese dipping sauce production line. The existing machine was purchased

Please show work on excel

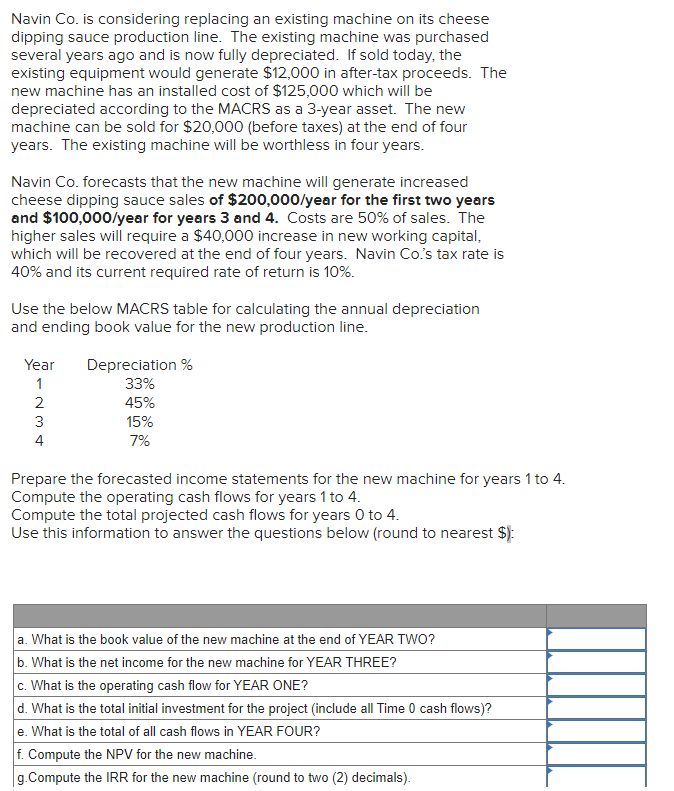

Navin Co. is considering replacing an existing machine on its cheese dipping sauce production line. The existing machine was purchased several years ago and is now fully depreciated. If sold today, the existing equipment would generate $12,000 in after-tax proceeds. The new machine has an installed cost of $125,000 which will be depreciated according to the MACRS as a 3-year asset. The new machine can be sold for $20,000 (before taxes) at the end of four years. The existing machine will be worthless in four years. Navin Co. forecasts that the new machine will generate increased cheese dipping sauce sales of $200,000/year for the first two years and $100,000/year for years 3 and 4. Costs are 50% of sales. The higher sales will require a $40,000 increase in new working capital, which will be recovered at the end of four years. Navin Co.'s tax rate is 40% and its current required rate of return is 10%. Use the below MACRS table for calculating the annual depreciation and ending book value for the new production line. Year Depreciation % 33% 1 2 45% 3 15% 7% 4 Prepare the forecasted income statements for the new machine for years 1 to 4. Compute the operating cash flows for years 1 to 4. Compute the total projected cash flows for years 0 to 4. Use this information to answer the questions below (round to nearest $): a. What is the book value of the new machine at the end of YEAR TWO? b. What is the net income for the new machine for YEAR THREE? c. What is the operating cash flow for YEAR ONE? d. What is the total initial investment for the project (include all Time 0 cash flows)? e. What is the total of all cash flows in YEAR FOUR? f. Compute the NPV for the new machine. g.Compute the IRR for the new machine (round to two (2) decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts