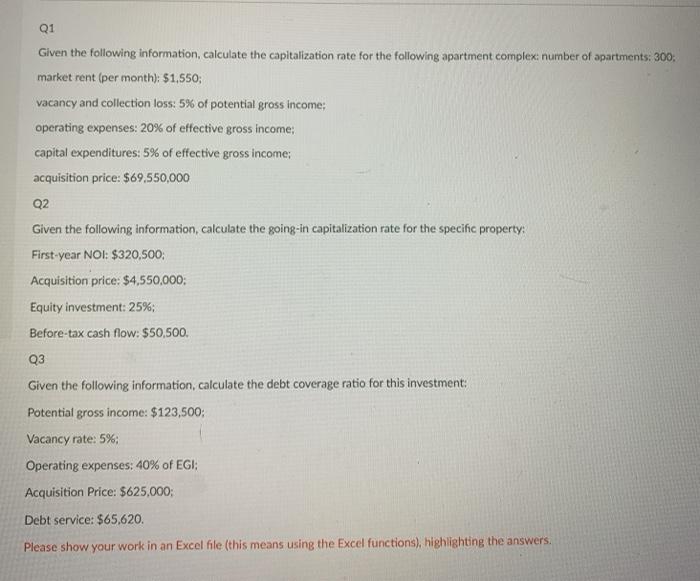

Question: please show work on excel Q1 Given the following information, calculate the capitalization rate for the following apartment complex number of apartments: 300; market rent

Q1 Given the following information, calculate the capitalization rate for the following apartment complex number of apartments: 300; market rent (per month): $1,550; vacancy and collection loss: 5% of potential gross income: operating expenses: 20% of effective gross income: capital expenditures: 5% of effective gross income: acquisition price: $69,550,000 Q2 Given the following information, calculate the going-in capitalization rate for the specific property: First-year NOI: $320,500 Acquisition price: $4,550,000: Equity investment: 25%; Before-tax cash flow: $50,500. Q3 Given the following information, calculate the debt coverage ratio for this investment: Potential gross income: $123,500: Vacancy rate: 5%: Operating expenses: 40% of EGI: Acquisition Price: $625.000; Debt service: $65.620. Please show your work in an Excel file (this means using the Excel functions), highlighting the answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts