Question: ***Please show work on how the numbers in the grid are calculated. Thanks!*** Management of ZeeKat, Inc. (ZeeKat) is planning to install new order processing

***Please show work on how the numbers in the grid are calculated. Thanks!***

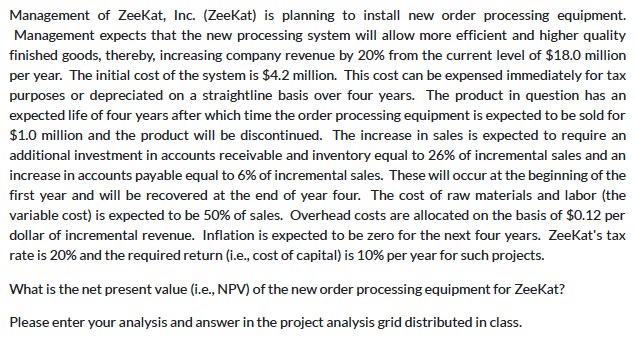

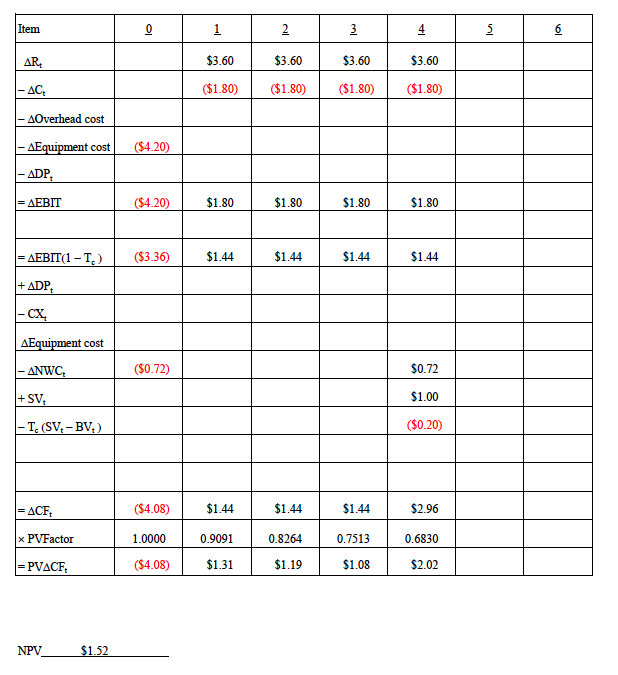

Management of ZeeKat, Inc. (ZeeKat) is planning to install new order processing equipment. Management expects that the new processing system will allow more efficient and higher quality finished goods, thereby, increasing company revenue by 20% from the current level of $18.0 million per year. The initial cost of the system is $4.2 million. This cost can be expensed immediately for tax purposes or depreciated on a straightline basis over four years. The product in question has an expected life of four years after which time the order processing equipment is expected to be sold for $1.0 million and the product will be discontinued. The increase in sales is expected to require an additional investment in accounts receivable and inventory equal to 26% of incremental sales and an increase in accounts payable equal to 6% of incremental sales. These will occur at the beginning of the first year and will be recovered at the end of year four. The cost of raw materials and labor (the variable cost) is expected to be 50% of sales. Overhead costs are allocated on the basis of $0.12 per dollar of incremental revenue. Inflation is expected to be zero for the next four years. ZeeKat's tax rate is 20% and the required return (i.e., cost of capital) is 10% per year for such projects. What is the net present value (i.e., NPV) of the new order processing equipment for ZeeKat? Please enter your analysis and answer in the project analysis grid distributed in class. NPV $1.52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts