Question: Please show work on how to calculate fixed and variable costs CompDesk, Inc., makes a single model of an ergonomic desk (with chair) for computer

Please show work on how to calculate fixed and variable costs

Please show work on how to calculate fixed and variable costs

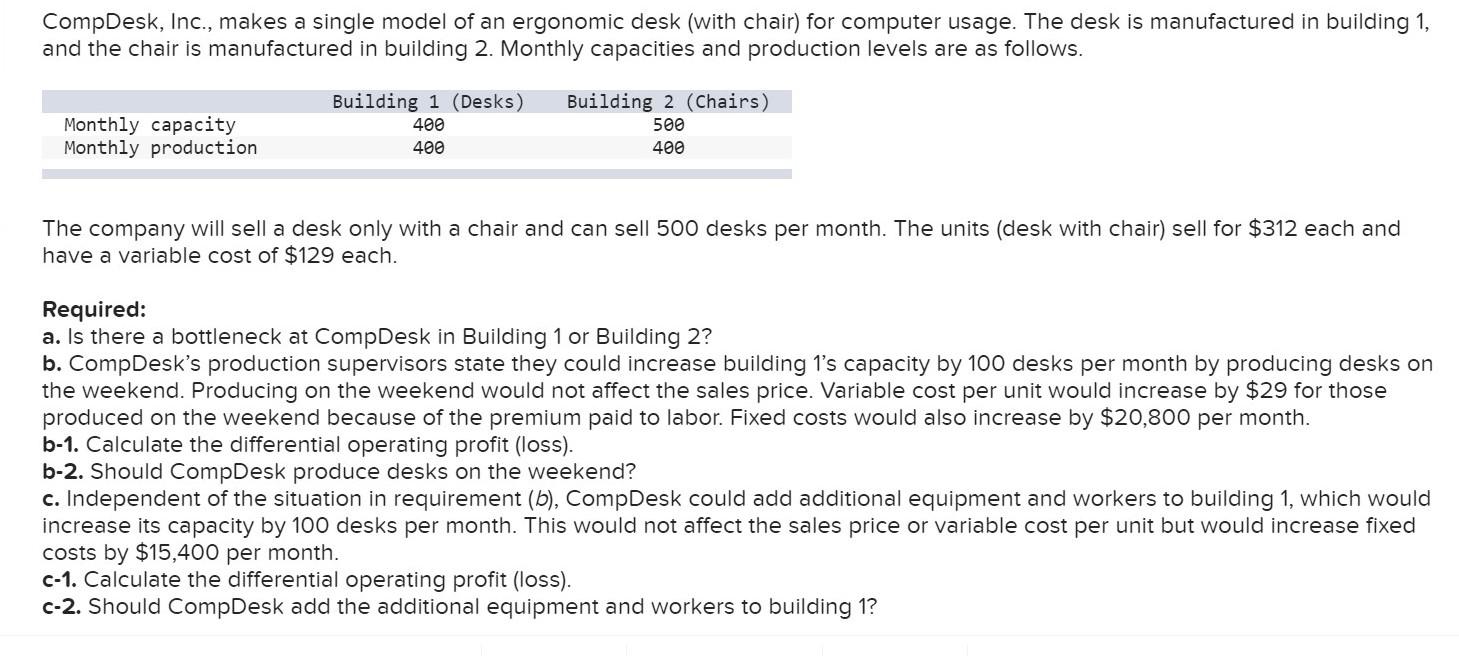

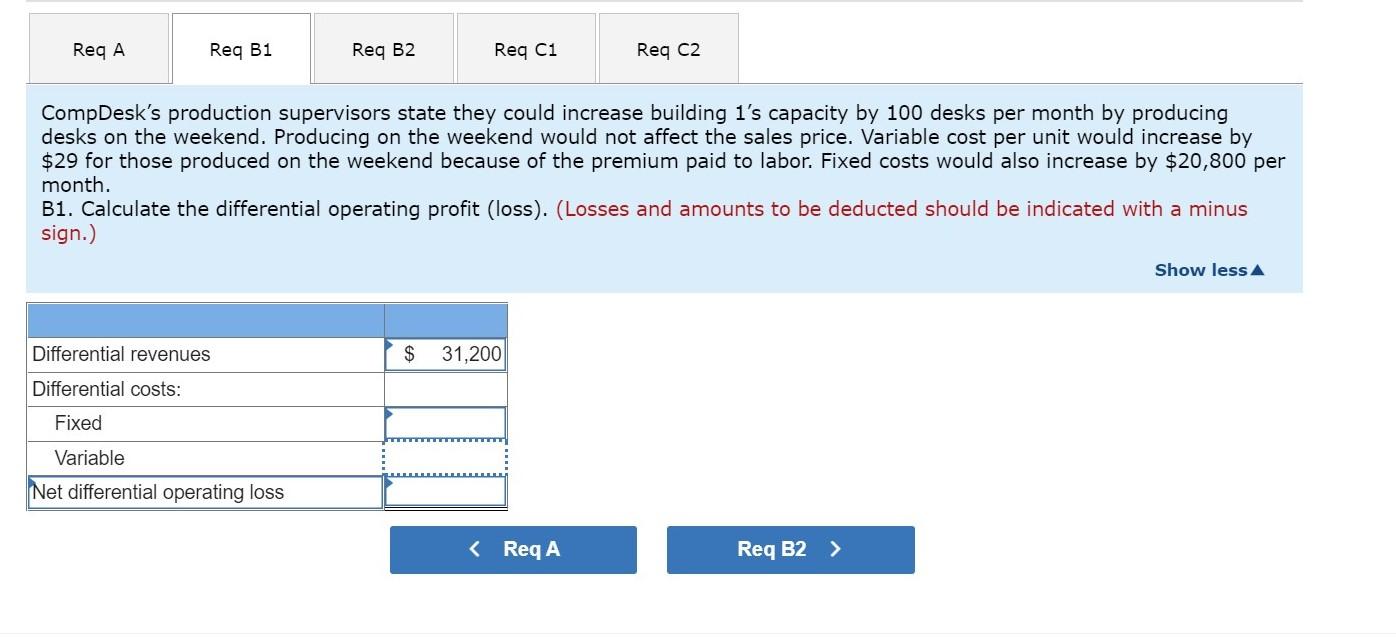

CompDesk, Inc., makes a single model of an ergonomic desk (with chair) for computer usage. The desk is manufactured in building 1, and the chair is manufactured in building 2. Monthly capacities and production levels are as follows. Monthly capacity Monthly production Building 1 (Desks) 400 400 Building 2 (Chairs) 500 400 The company will sell a desk only with a chair and can sell 500 desks per month. The units (desk with chair) sell for $312 each and have a variable cost of $129 each. Required: a. Is there a bottleneck at CompDesk in Building 1 or Building 2? b. CompDesk's production supervisors state they could increase building 1's capacity by 100 desks per month by producing desks on the weekend. Producing on the weekend would not affect the sales price. Variable cost per unit would increase by $29 for those produced on the weekend because of the premium paid to labor. Fixed costs would also increase by $20,800 per month. b-1. Calculate the differential operating profit (loss). b-2. Should CompDesk produce desks on the weekend? c. Independent of the situation in requirement (b), CompDesk could add additional equipment and workers to building 1, which would increase its capacity by 100 desks per month. This would not affect the sales price or variable cost per unit but would increase fixed costs by $15,400 per month. C-1. Calculate the differential operating profit (loss). c-2. Should CompDesk add the additional equipment and workers to building 1? Req A Req B1 Req B2 Req C1 Reg C2 CompDesk's production supervisors state they could increase building 1's capacity by 100 desks per month by producing desks on the weekend. Producing on the weekend would not affect the sales price. Variable cost per unit would increase by $29 for those produced on the weekend because of the premium paid to labor. Fixed costs would also increase by $20,800 per month. B1. Calculate the differential operating profit (loss). (Losses and amounts to be deducted should be indicated with a minus sign.) Show less Differential revenues $ 31,200 Differential costs: Fixed Variable Net differential operating loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts