Question: Please show work or cell references, this is a tough subject for me. Question 10 Winter Park Cleaning Company has a $1,000 par value, 20-year

Please show work or cell references, this is a tough subject for me.

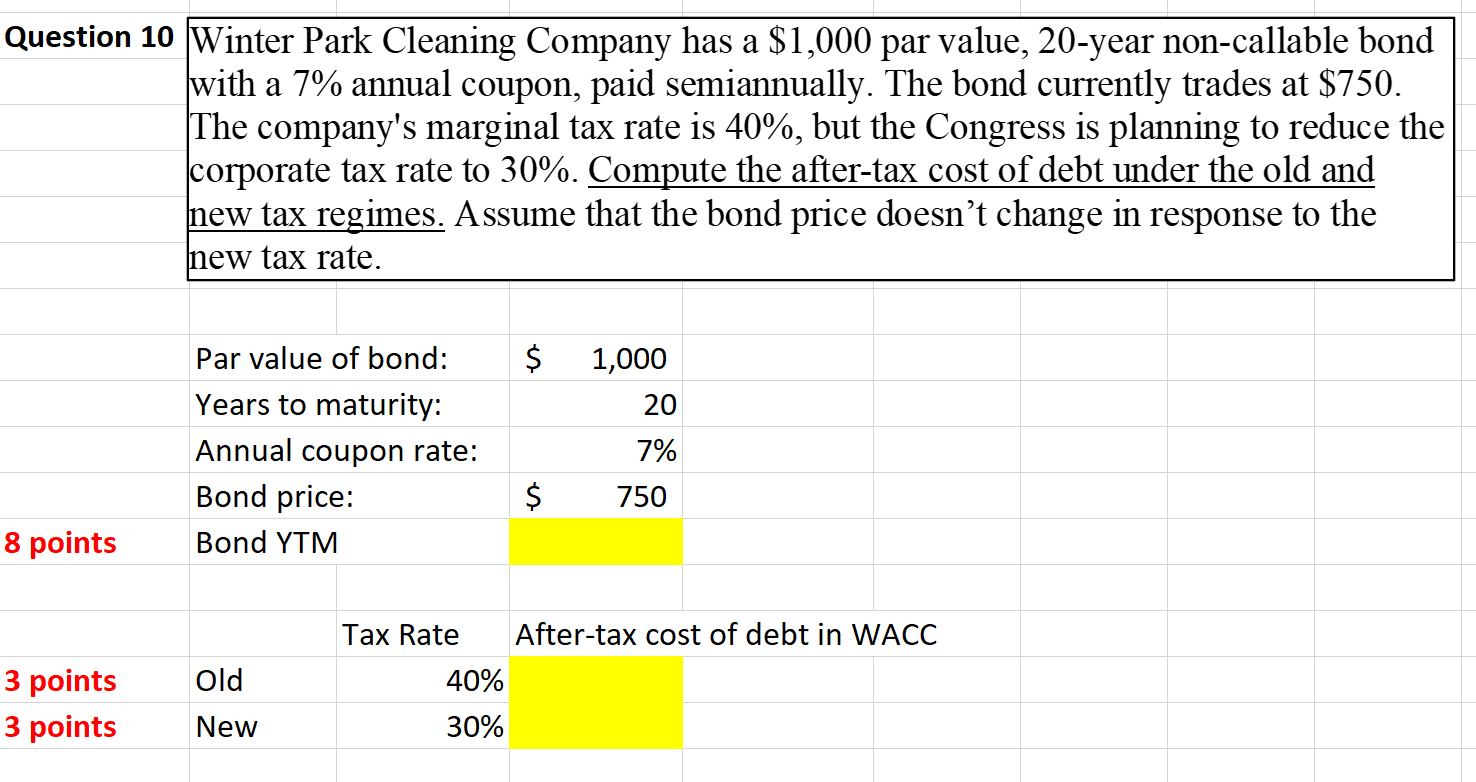

Question 10 Winter Park Cleaning Company has a $1,000 par value, 20-year non-callable bond with a 7% annual coupon, paid semiannually. The bond currently trades at $750. The company's marginal tax rate is 40%, but the Congress is planning to reduce the corporate tax rate to 30%. Compute the after-tax cost of debt under the old and new tax regimes. Assume that the bond price doesn't change in response to the new tax rate. $ Par value of bond: Years to maturity: Annual coupon rate: Bond price: Bond YTM 1,000 20 7% $ 750 8 points old 3 points 3 points Tax Rate After-tax cost of debt in WACC 40% 30% New

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts