Question: Please show work Please use the tables below to help you calculate 2023 tax liability (or refund) in each of the following independent scenarios. Please

Please show work

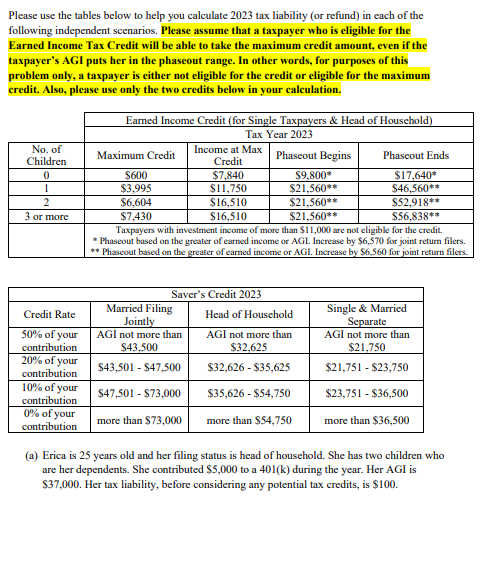

Please use the tables below to help you calculate 2023 tax liability (or refund) in each of the following independent scenarios. Please assume that a taxpayer who is eligible for the Earned Income Tax Credit will be able to take the maximum credit amount, even if the taxpayer's AGI puts her in the phaseout range. In other words, for purposes of this problem only, a taxpayer is either not eligible for the credit or eligible for the maximum credit. Also, please use only the two credits below in your calculation. (a) Erica is 25 years old and her filing status is head of household. She has two children who are her dependents. She contributed $5,000 to a 401(k) during the year. Her AGI is $37,000. Her tax liability, before considering any potential tax credits, is $100. (b) Jane and Dan, both age 50, are married and file a joint return. They have one child who is their dependent. Jane contributed $1,000 to a 401(k) during the year. Dan contributed $6,500 to a traditional IRA. Their AGI is $44,000. Their tax liability, before considering any potential tax credits, is $9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts