Question: please show work! Present Value and Interest rate Suppose one share of Amazon earns and pays out $10 per year and will do so forever.

please show work!

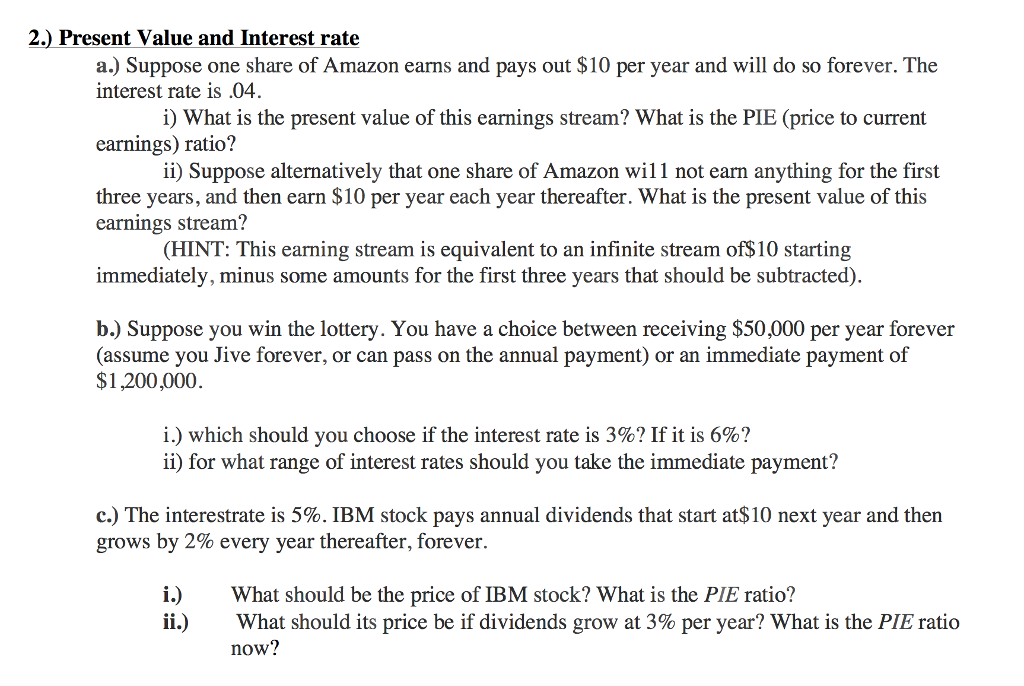

Present Value and Interest rate Suppose one share of Amazon earns and pays out $10 per year and will do so forever. The interest rate is .04. What is the present value of this earnings stream? What is the PIE (price to current earnings) ratio? Suppose alternatively that one share of Amazon will not earn anything for the first three years, and then earn $10 per year each year thereafter. What is the present value of this earnings stream? Suppose you win the lottery. You have a choice between receiving $50,000 per year forever (assume you Jive forever, or can pass on the annual payment) or an immediate payment of $1, 200,000. which should you choose if the interest rate is 3%? If it is 6%? for what range of interest rates should you take the immediate payment? The interestrate is 5%. IBM stock pays annual dividends that start at $10 next year and then grows by 2% every year thereafter, forever. What should be the price of IBM stock? What is the PIE ratio? What should its price be if dividends grow at 3% per year? What is the PIE ratio now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts