Question: Please show work! PROBLEM 2 (10 POINTS) On December 31, 2022, Rhone-Metro Industries leased equipment to Western Soya Co. for a S-year period ending December

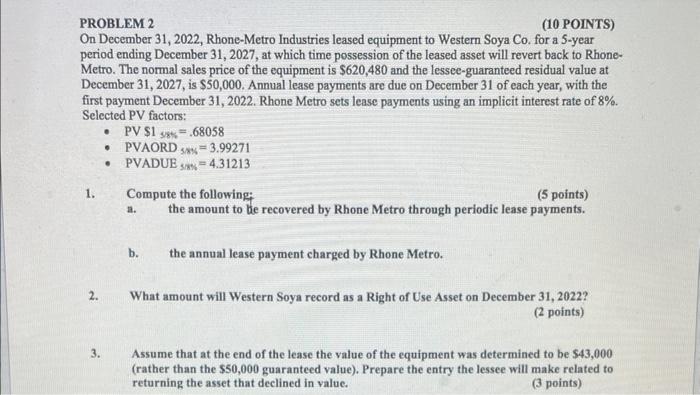

PROBLEM 2 (10 POINTS) On December 31, 2022, Rhone-Metro Industries leased equipment to Western Soya Co. for a S-year period ending December 31,2027 , at which time possession of the leased asset will revert back to RhoneMetro. The normal sales price of the equipment is $620,480 and the lessee-guaranteed residual value at December 31,2027 , is $50,000. Annual lease payments are due on December 31 of each year, with the first payment December 31, 2022. Rhone Metro sets lease payments using an implicit interest rate of 8%. Selected PV factors: - PV $1 s8s =.68058 - PVAORD 5.8=3.99271 - PVADUE sin=4.31213 1. Compute the following: (2 points) a. the amount to be recovered by Rhone Metro through periodic lease payments. b. the annual lease payment charged by Rhone Metro. 2. What amount will Western Soya record as a Right of Use Asset on December 31, 2022? (2 points) 3. Assume that at the end of the lease the value of the equipment was determined to be $43,000 (rather than the $50,000 guaranteed value). Prepare the entry the lessee will make related to returning the asset that declined in value. (3 points) PROBLEM 2 (10 POINTS) On December 31, 2022, Rhone-Metro Industries leased equipment to Western Soya Co. for a S-year period ending December 31,2027 , at which time possession of the leased asset will revert back to RhoneMetro. The normal sales price of the equipment is $620,480 and the lessee-guaranteed residual value at December 31,2027 , is $50,000. Annual lease payments are due on December 31 of each year, with the first payment December 31, 2022. Rhone Metro sets lease payments using an implicit interest rate of 8%. Selected PV factors: - PV $1 s8s =.68058 - PVAORD 5.8=3.99271 - PVADUE sin=4.31213 1. Compute the following: (2 points) a. the amount to be recovered by Rhone Metro through periodic lease payments. b. the annual lease payment charged by Rhone Metro. 2. What amount will Western Soya record as a Right of Use Asset on December 31, 2022? (2 points) 3. Assume that at the end of the lease the value of the equipment was determined to be $43,000 (rather than the $50,000 guaranteed value). Prepare the entry the lessee will make related to returning the asset that declined in value. (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts