Question: Please show work Problem 20-7 1 . The common stock of the PUTT Corporation has been trading in a narrow price range for the past

Please show work

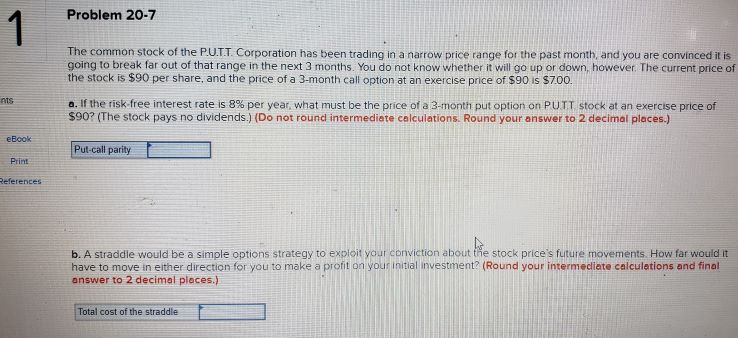

Problem 20-7 1 . The common stock of the PUTT Corporation has been trading in a narrow price range for the past month, and you are convinced it is going to break far out of that range in the next 3 months. You do not know whether it will go up or down, however. The current price of the stock is $90 per share, and the price of a 3-month call option at an exercise price of $90 is $700. a. If the risk free interest rate is 8% per year, what must be the price of a 3-month put option on PUTT stock at an exercise price of $90? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Ats eBook Put call parity Print References b. A straddle would be a simple options strategy to exploit your conviction about the stock price's future movements How far would it have to move in either direction for you to make a profit on your initial investment? (Round your intermediate calculations and final answer to 2 decimal places.) Total cost of the straddle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts