Question: Please Show work. Quad Enterprises is considering a new 3-year expansion project that requires an initial fixed asset investment of $4.428 million. The fixed asset

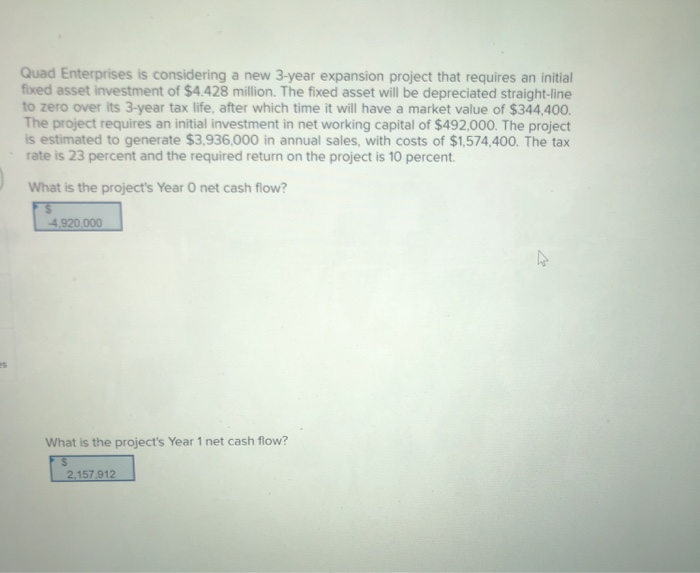

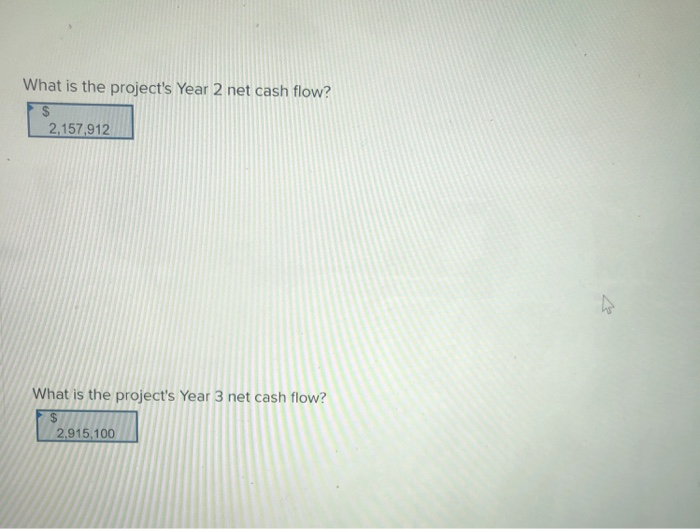

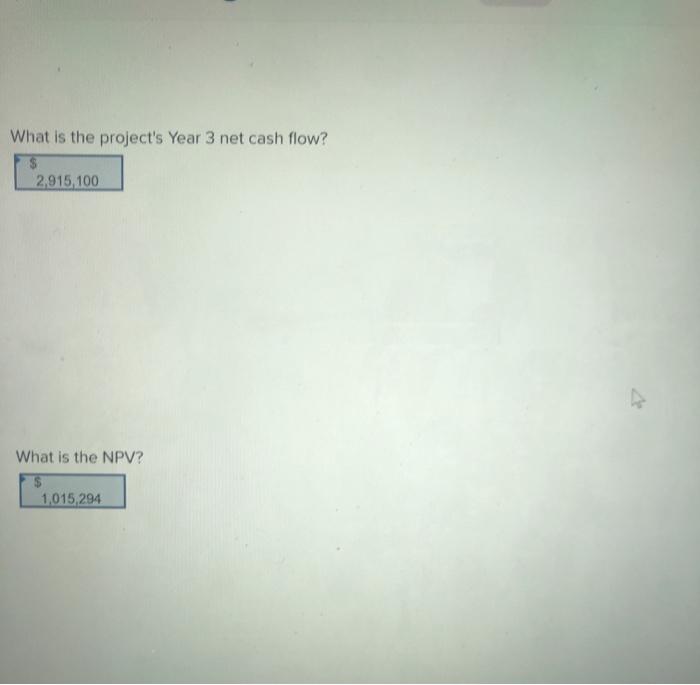

Quad Enterprises is considering a new 3-year expansion project that requires an initial fixed asset investment of $4.428 million. The fixed asset will be depreciated straight-line to zero over its 3-year tax life, after which time it will have a market value of $344,400. The project requires an initial investment in net working capital of $492,000. The project is estimated to generate $3,936,000 in annual sales, with costs of $1,574,400. The tax rate is 23 percent and the required return on the project is 10 percent. What is the project's Year Onet cash flow? 4.920,000 What is the project's Year 1 net cash flow? 3 2,157.912 What is the project's Year 2 net cash flow? $ 2,157,912 What is the project's Year 3 net cash flow? $ 2,915,100 What is the project's Year 3 net cash flow? 2,915,100 What is the NPV? 1,015,294

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts