Question: Please show work Question 10 Assume a $1,000 face value bond has a coupon rate of 7.7 percent paid semiannually and has an eight-year life.

Please show work

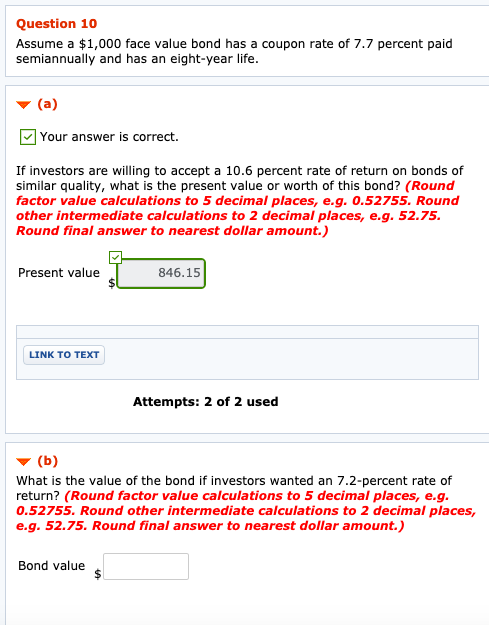

Question 10 Assume a $1,000 face value bond has a coupon rate of 7.7 percent paid semiannually and has an eight-year life. (a) Your answer is correct. If investors are willing to accept a 10.6 percent rate of return on bonds of similar quality, what is the present value or worth of this bond? (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount.) Present value 846.15 LINK TO TEXT Attempts: 2 of 2 used (b) What is the value of the bond if investors wanted an 7.2-percent rate of return? (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount.) Bond value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts