Question: Please Show Work Question 12 0 / 4 pts On 12-31-19, O issued $2,000,000 of its 3%, 2-year callable term bonds dated 12-31-19. The bonds

Please Show Work

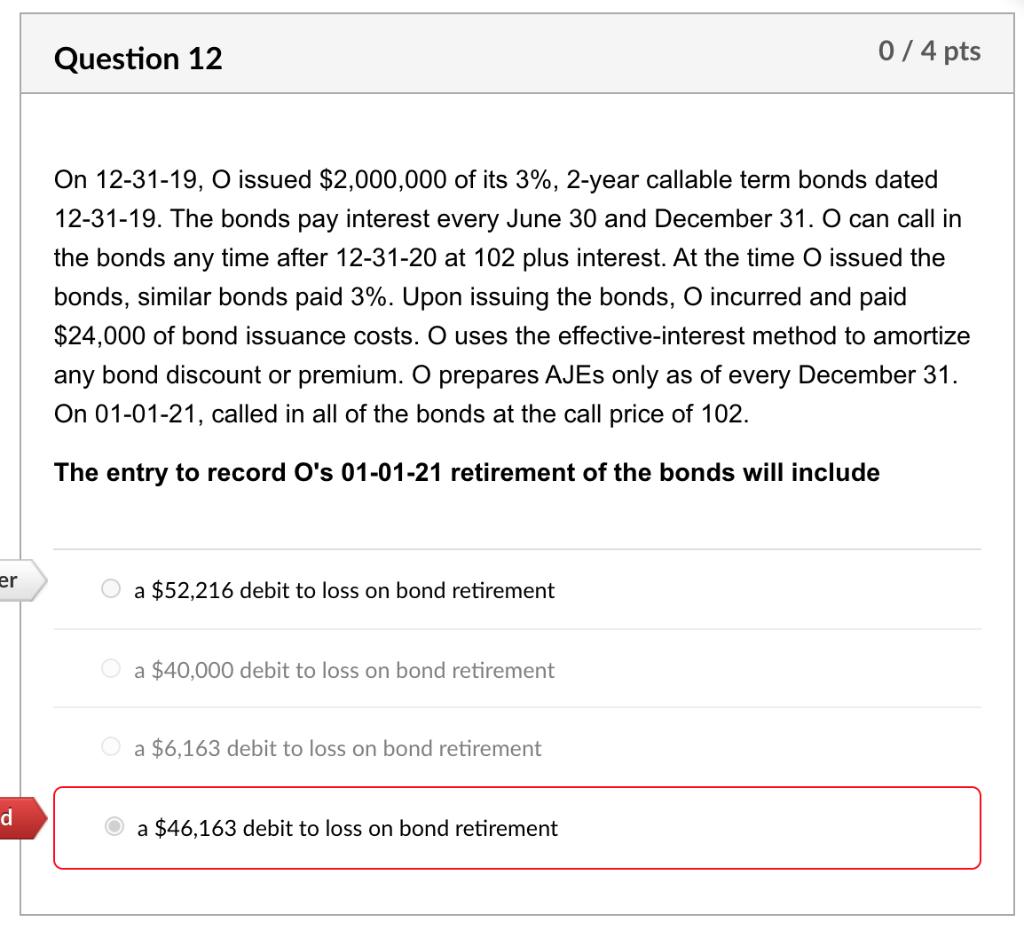

Question 12 0 / 4 pts On 12-31-19, O issued $2,000,000 of its 3%, 2-year callable term bonds dated 12-31-19. The bonds pay interest every June 30 and December 31. O can call in the bonds any time after 12-31-20 at 102 plus interest. At the time O issued the bonds, similar bonds paid 3%. Upon issuing the bonds, O incurred and paid $24,000 of bond issuance costs. O uses the effective-interest method to amortize any bond discount or premium. O prepares AJEs only as of every December 31. On 01-01-21, called in all of the bonds at the call price of 102. The entry to record O's 01-01-21 retirement of the bonds will include er a $52,216 debit to loss on bond retirement a $40,000 debit to loss on bond retirement 0 a $6,163 debit to loss on bond retirement d a $46,163 debit to loss on bond retirement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts