Question: Please show work Question 3 1 pts Assume that the prices for a stock follow a lognormal distribution. The current price of the stock is

Please show work

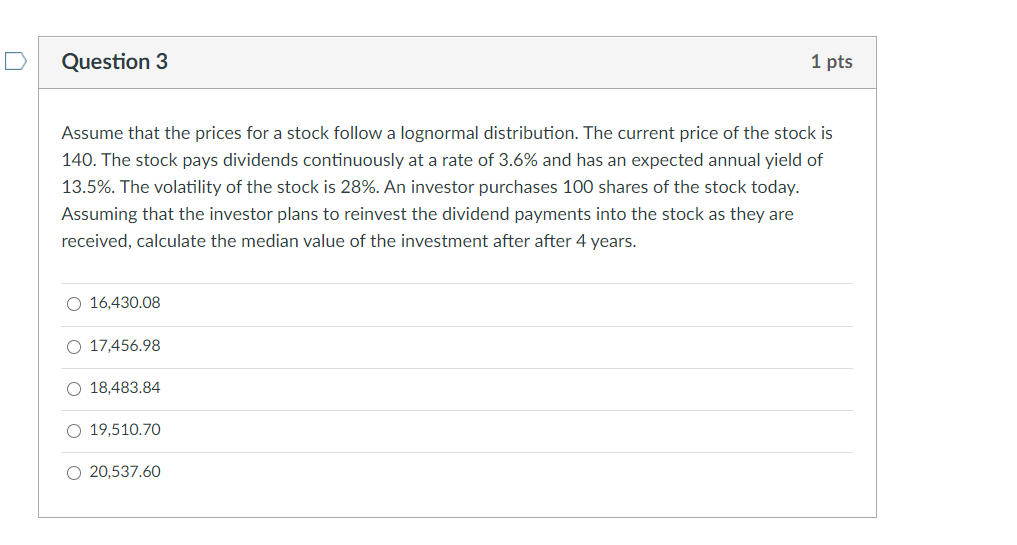

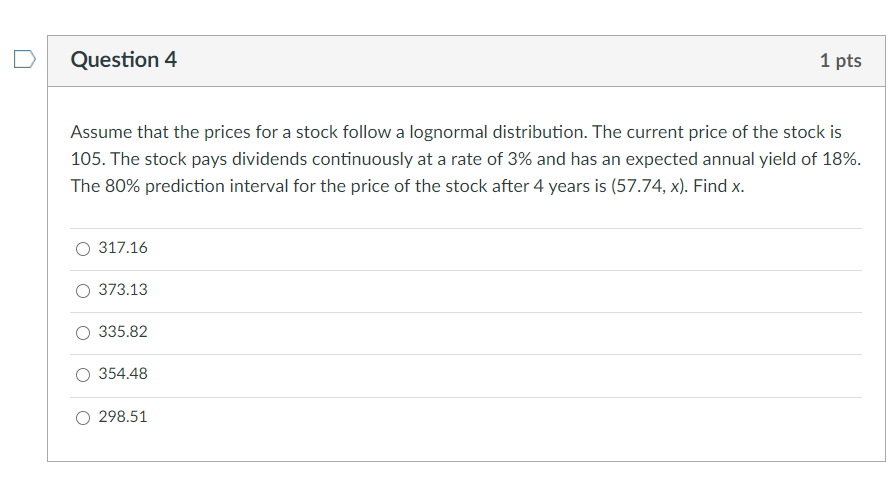

Question 3 1 pts Assume that the prices for a stock follow a lognormal distribution. The current price of the stock is 140. The stock pays dividends continuously at a rate of 3.6% and has an expected annual yield of 13.5%. The volatility of the stock is 28%. An investor purchases 100 shares of the stock today. Assuming that the investor plans to reinvest the dividend payments into the stock as they are received, calculate the median value of the investment after after 4 years. O 16,430.08 O 17,456.98 O 18,483.84 O 19,510.70 O 20,537.60 D Question 4 1 pts Assume that the prices for a stock follow a lognormal distribution. The current price of the stock is 105. The stock pays dividends continuously at a rate of 3% and has an expected annual yield of 18%. The 80% prediction interval for the price of the stock after 4 years is (57.74, x). Find x. O 317.16 373.13 335.82 354.48 O 298.51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts