Question: Please show work Question 3 (25 points A small manufacturing plant needs a new compressor and has received two bids. compressor has an initial cost

Please show work

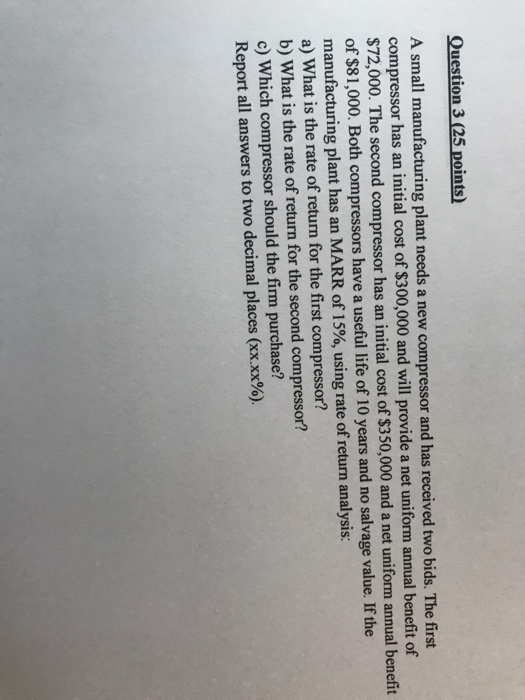

Please show work Question 3 (25 points A small manufacturing plant needs a new compressor and has received two bids. compressor has an initial cost of $300,000 and will provide a net uniform annual benefit of $72,000. The second compressor has an initial cost of S of $81,000. Both compressors have a useful life of 10 years and no salvage value. If the manufacturing plant has an MARR of 15%, using rate of return analysis a) What is the rate of return for the first compressor? b) What is the rate of return for the second compressor? c) Which compressor should the firm purchase? Report all answers to two decimal places (xx.xx%). The first

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts