Question: please show work Question 3 (3 points) You are considering purchasing an office building for $2,750,000. You expect the potential gross income (PGI) in the

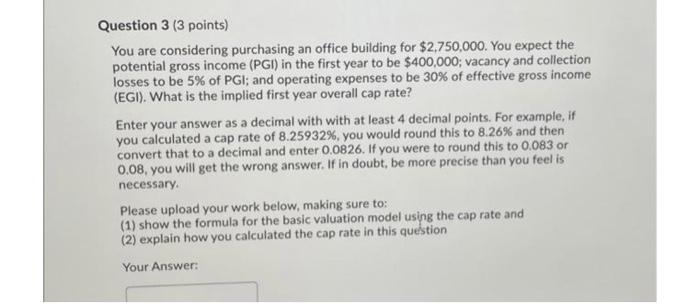

Question 3 (3 points) You are considering purchasing an office building for $2,750,000. You expect the potential gross income (PGI) in the first year to be $400,000; vacancy and collection losses to be 5% of PGI; and operating expenses to be 30% of effective gross income (EGI). What is the implied first year overall cap rate? Enter your answer as a decimal with with at least 4 decimal points. For example, if you calculated a cap rate of 8.25932%, you would round this to 8.26% and then convert that to a decimal and enter 0.0826. If you were to round this to 0.083 or 0.08, you will get the wrong answer. If in doubt, be more precise than you feel is necessary Please upload your work below, making sure to: (1) show the formula for the basic valuation model using the cap rate and (2) explain how you calculated the cap rate in this question Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts