Question: please show work Question 7 0 / 4 pts On 01-01-19, Smith had 360,000 shares of common stock outstanding. On 10-01- 19, Smith bought back

please show work

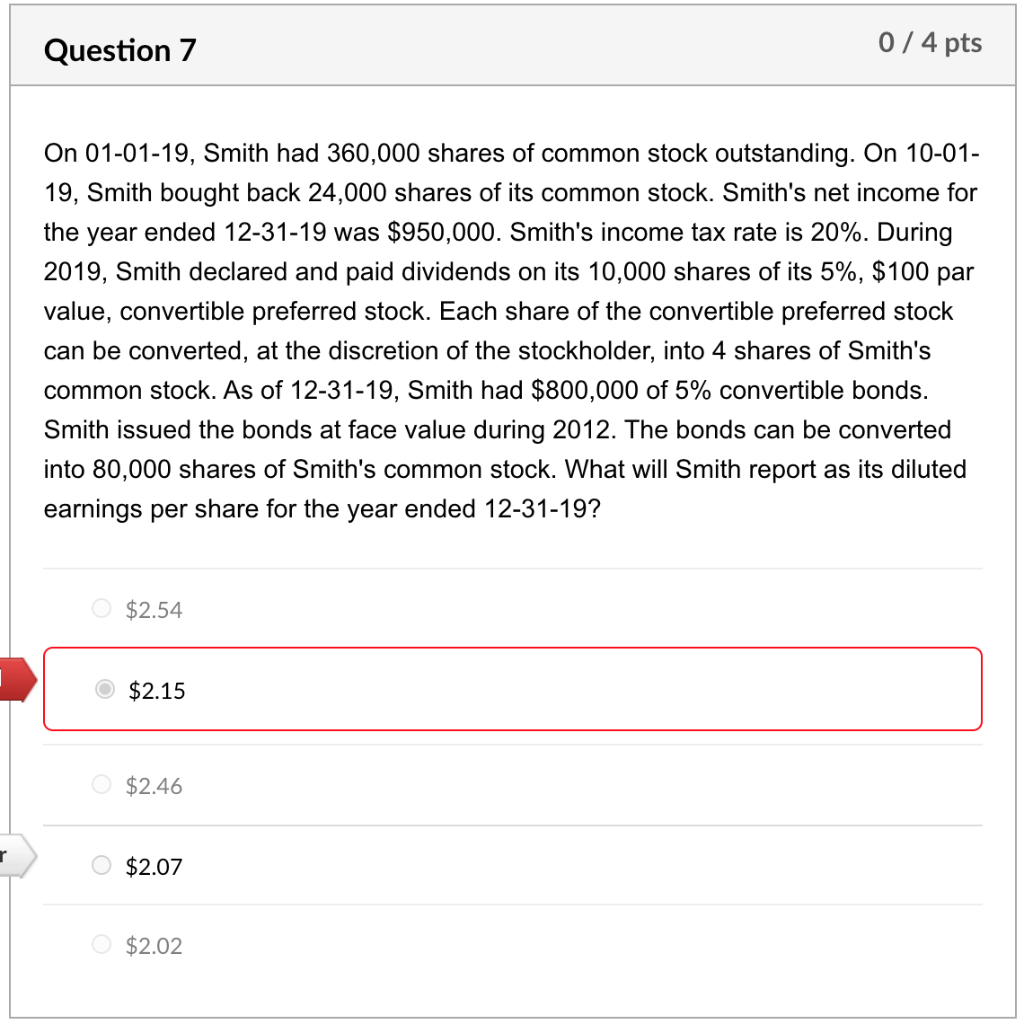

Question 7 0 / 4 pts On 01-01-19, Smith had 360,000 shares of common stock outstanding. On 10-01- 19, Smith bought back 24,000 shares of its common stock. Smith's net income for the year ended 12-31-19 was $950,000. Smith's income tax rate is 20%. During 2019, Smith declared and paid dividends on its 10,000 shares of its 5%, $100 par value, convertible preferred stock. Each share of the convertible preferred stock can be converted, at the discretion of the stockholder, into 4 shares of Smith's common stock. As of 12-31-19, Smith had $800,000 of 5% convertible bonds. Smith issued the bonds at face value during 2012. The bonds can be converted into 80,000 shares of Smith's common stock. What will Smith report as its diluted earnings per share for the year ended 12-31-19? $2.54 $2.15 0 $2.46 r O $2.07 0 $2.02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts