Question: please show work Robinson Co. is interested in purchasing a new delivery vehicle so it can become a subcontractor with Amazon Logistics. The vehicle costs

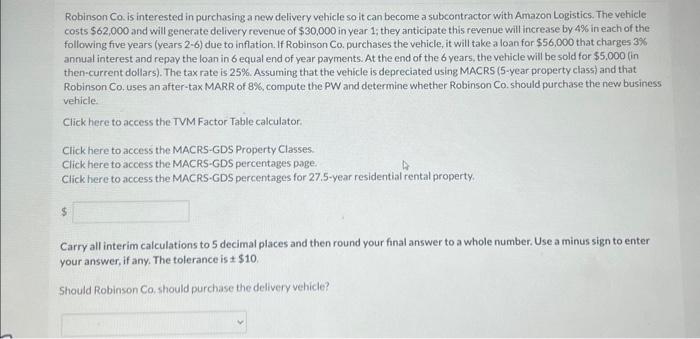

Robinson Co. is interested in purchasing a new delivery vehicle so it can become a subcontractor with Amazon Logistics. The vehicle costs $62,000 and will generate delivery revenue of $30,000 in year 1 ; they anticipate this revenue will increase by 4% in each of the following five years (years 2-6) due to inflation. If Robinson Co. purchases the vehicle, it will take a loan for $56,000 that charges 3% annual interest and repay the loan in 6 equal end of year payments. At the end of the 6 years, the vehicle will be sold for $5,000 (in then-current dollars). The tax rate is 25%. Assuming that the vehicle is depreciated using MACRS (5-year property class) and that Robinson Co. uses an after-tax MARR of B\%, compute the PW and determine whether Robinson Co. should purchase the new business vehicle. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. Use a minus sign to enter your answer, if any. The tolerance is $10. Should Robinson Co, should purchase the delivery vehicle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts