Question: Please show work! SIU retirement fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term corporate bond

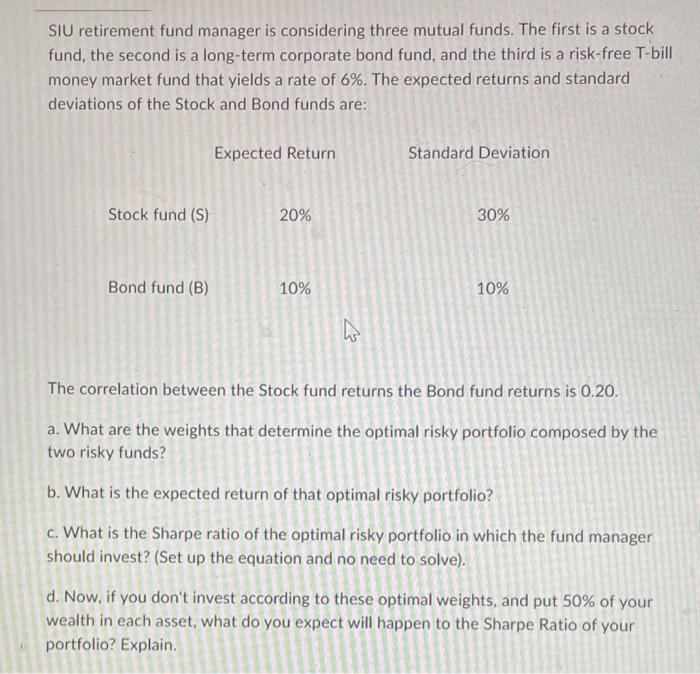

SIU retirement fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term corporate bond fund, and the third is a risk-free T-bill money market fund that yields a rate of 6%. The expected returns and standard deviations of the Stock and Bond funds are: The correlation between the Stock fund returns the Bond fund returns is 0.20. a. What are the weights that determine the optimal risky portfolio composed by the two risky funds? b. What is the expected return of that optimal risky portfolio? c. What is the Sharpe ratio of the optimal risky portfolio in which the fund manager should invest? (Set up the equation and no need to solve). d. Now, if you don't invest according to these optimal weights, and put 50% of your wealth in each asset, what do you expect will happen to the Sharpe Ratio of your portfolio? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts