Question: Please show work so I can learn. Thank you :) Problem 20-16 Put-call parity The common stock of Triangular File Company is selling at $101.

Please show work so I can learn. Thank you :)

Please show work so I can learn. Thank you :)

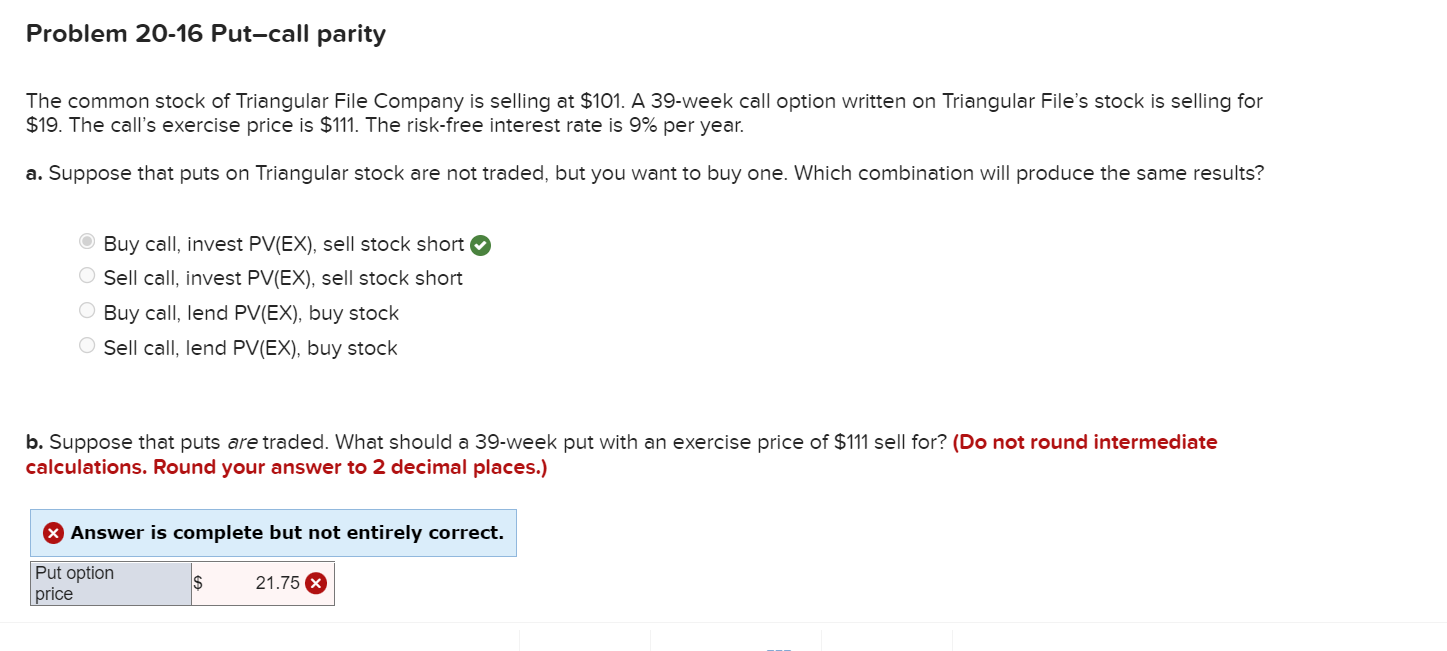

Problem 20-16 Put-call parity The common stock of Triangular File Company is selling at $101. A 39-week call option written on Triangular File's stock is selling for $19. The call's exercise price is $111. The risk-free interest rate is 9% per year. a. Suppose that puts on Triangular stock are not traded, but you want to buy one. Which combination will produce the same results? Buy call, invest PV(EX), sell stock short Sell call, invest PV(EX), sell stock short Buy call, lend PV(EX), buy stock Sell call, lend PV(EX), buy stock b. Suppose that puts are traded. What should a 39-week put with an exercise price of $111 sell for? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Put option $ 21.75 X price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts