Question: please show work so i can understand how to do it. thank you! Fifth Bank has the following balance sheet with values stated in millions

please show work so i can understand how to do it. thank you!

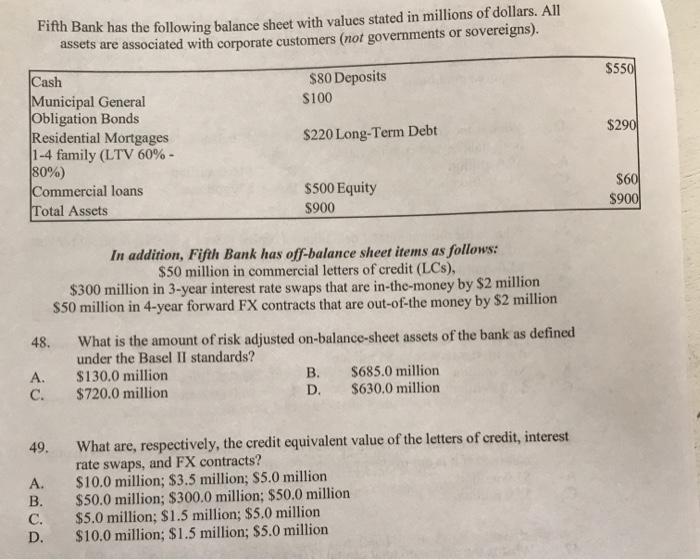

please show work so i can understand how to do it. thank you!Fifth Bank has the following balance sheet with values stated in millions of dollars. All assets are associated with corporate customers (not governments or sovereigns). $550 $80 Deposits S100 $290 $220 Long-Term Debt Cash Municipal General Obligation Bonds Residential Mortgages 1-4 family (LTV 60%- 80%) Commercial loans Total Assets $500 Equity $900 $60 $900 In addition, Fifth Bank has off-balance sheet items as follows: $50 million in commercial letters of credit (LCs), $300 million in 3-year interest rate swaps that are in-the-money by $2 million $50 million in 4-year forward FX contracts that are out-of-the money by $2 million 48. What is the amount of risk adjusted on-balance-sheet assets of the bank as defined under the Basel II standards? A. $130.0 million B. $685.0 million C. $720.0 million D. $630.0 million 49. A. B. C. D. What are, respectively, the credit equivalent value of the letters of credit, interest rate swaps, and FX contracts? $10.0 million; $3.5 million; $5.0 million $50.0 million; $300.0 million: $50.0 million $5.0 million; $1.5 million; $5.0 million $10.0 million; $1.5 million; $5.0 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts