Question: Please show work, step by step. Thanks! An extract from Jas's statement of financial position at 31 December 2019 showed the following: Cost Accumulated Net

Please show work, step by step. Thanks!

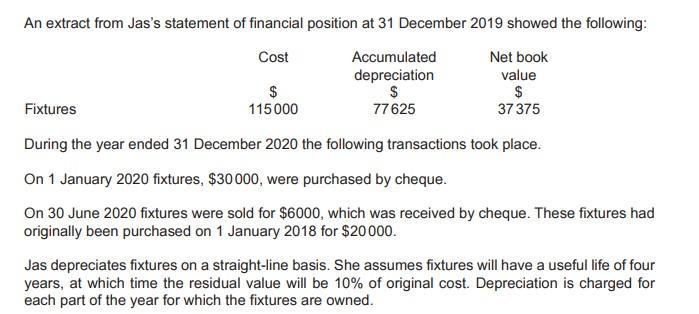

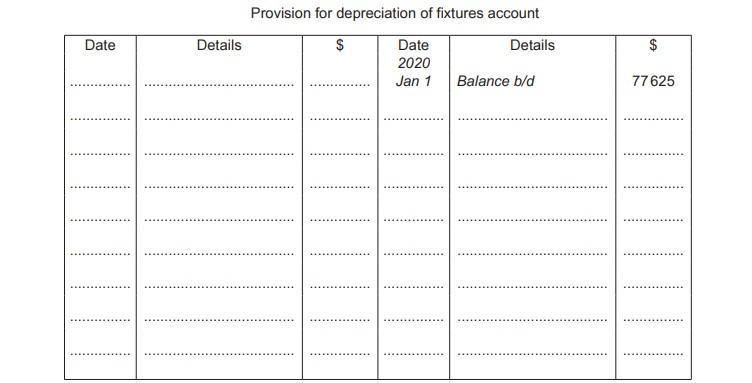

An extract from Jas's statement of financial position at 31 December 2019 showed the following: Cost Accumulated Net book value depreciation $ 77625 $ 37 375 $ 115000 Fixtures During the year ended 31 December 2020 the following transactions took place. On 1 January 2020 fixtures, $30000, were purchased by cheque. On 30 June 2020 fixtures were sold for $6000, which was received by cheque. These fixtures had originally been purchased on 1 January 2018 for $20000. Jas depreciates fixtures on a straight-line basis. She assumes fixtures will have a useful life of four years, at which time the residual value will be 10% of original cost. Depreciation is charged for each part of the year for which the fixtures are owned.

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

since in given problem for calculation of deprecation straightline method is used Annual deprecation cost salvage value useful life The original cost ... View full answer

Get step-by-step solutions from verified subject matter experts