Question: please show work step by step to better understand the problem :) thank you Viera Corporation is considering investing in a new facility. The estimated

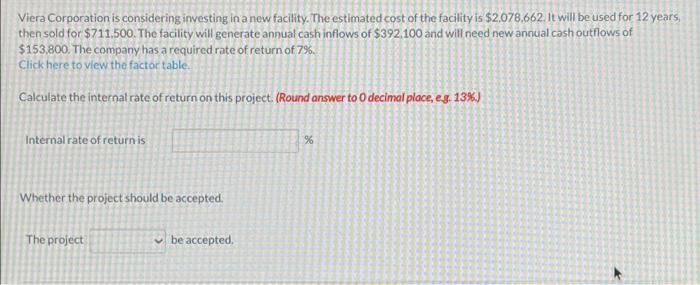

Viera Corporation is considering investing in a new facility. The estimated cost of the facility is $2,078.662. It will be used for 12 years, then sold for $711,500. The facility will generate annual cash inflows of $392,100 and will need new annual cash outflows of $153,800. The company has a required rate of return of 7%. Click here to view the factor table. Calculate the internal rate of return on this project. (Round answer to 0 decimal place, eg. 13\%) Internal rate of return is % Whether the project should be accepted. The project be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts