Question: Please show work. Thank you 3.1 There are two possible investment projects a firm is facing. The cash flows are given as follows: Initial Investment

Please show work. Thank you

Please show work. Thank you

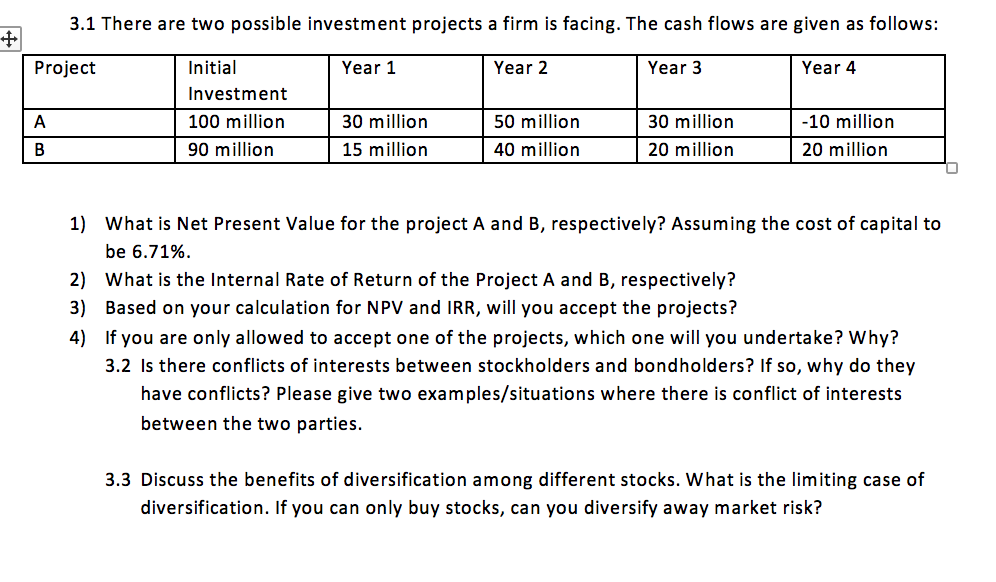

3.1 There are two possible investment projects a firm is facing. The cash flows are given as follows: Initial Investment 100 million 90 million Project Year 1 Year 2 Year 3 Year 4 30 million 15 million 50 million 40 million 30 million 20 million 10 million 20 million 1) What is Net Present Value for the project A and B, respectively? Assuming the cost of capital to be 6.71% What is the Internal Rate of Return of the Project A and B, respectively? Based on your calculation for NPV and IRR, will you accept the projects? If you are only allowed to accept one of the projects, which one will you undertake? Why? 3.2 Is there conflicts of interests between stockholders and bondholders? If so, why do they 2) 3) 4) have conflicts? Please give two examples/situations where there is conflict of interests between the two parties. 3.3 Discuss the benefits of diversification among different stocks. What is the limiting case of diversification. If you can only buy stocks, can you diversify away market risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts