Question: Please show work. Thank you Question 2. Consider a model in which two countries compete for an FDI project. If located in country 1 ,

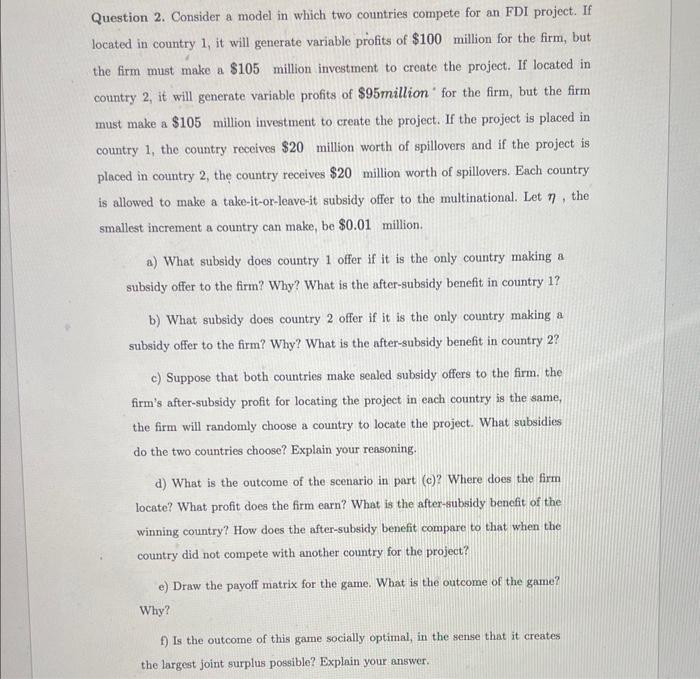

Question 2. Consider a model in which two countries compete for an FDI project. If located in country 1 , it will generate variable profits of $100 million for the firm, but the firm must make a $105 million investment to create the project. If located in country 2, it will generate variable profits of $95 million " for the firm, but the firm must make a $105 million investment to create the project. If the project is placed in country 1 , the country receives $20 million worth of spillovers and if the project is placed in country 2 , the country receives $20 million worth of spillovers. Each country is allowed to make a take-it-or-leave-it subsidy offer to the multinational. Let , the smallest increment a country can make, be $0.01 million. a) What subsidy does country 1 offer if it is the only country making a subsidy offer to the firm? Why? What is the after-subsidy benefit in country 1 ? b) What subsidy does country 2 offer if it is the only country making a subsidy offer to the firm? Why? What is the after-subsidy benefit in country 2 ? c) Suppose that both countries make sealed subsidy offers to the firm. the firm's after-subsidy profit for locating the project in each country is the same, the firm will randomly choose a country to locate the project. What subsidies do the two countries choose? Explain your reasoning. d) What is the outcome of the scenario in part (c)? Where does the firm locate? What profit does the firm earn? What is the after-subsidy benefit of the winning country? How does the after-subsidy benefit compare to that when the country did not compete with another country for the project? e) Draw the payoff matrix for the game. What is the outcome of the game? Why? f) Is the outcome of this game socially optimal, in the sense that it creates the largest joint surplus possible? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts