Question: Please show work through excel 1. Asset Allocation Your client is considering three mutual funds: a stock fund, a real estate fund and a T-bill

Please show work through excel

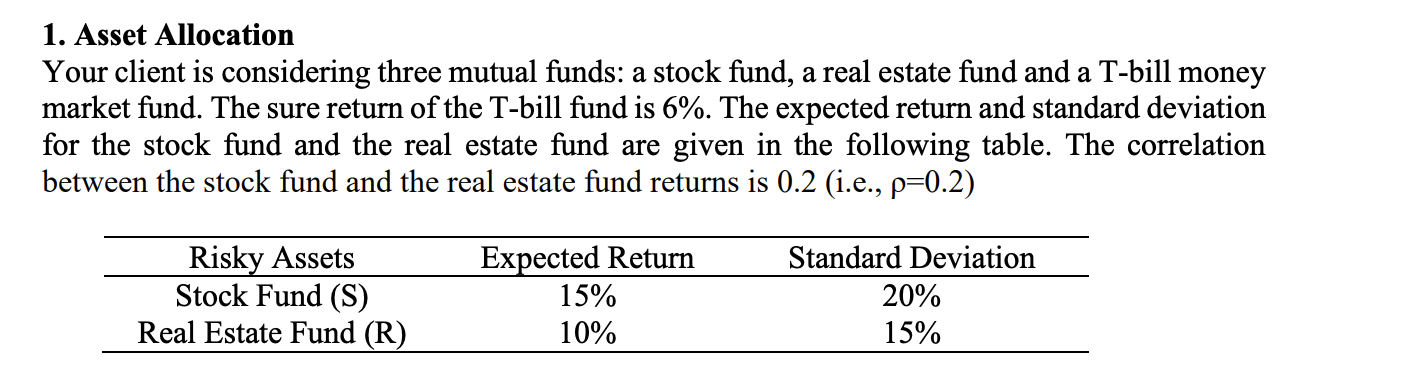

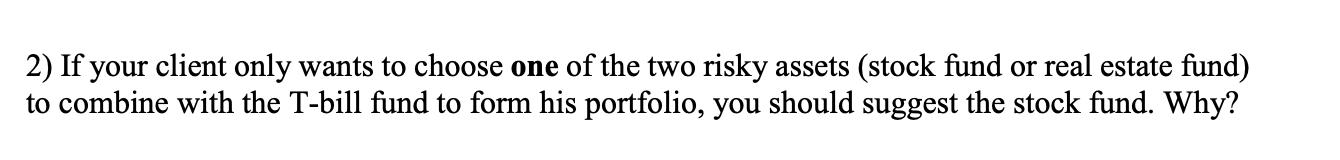

1. Asset Allocation Your client is considering three mutual funds: a stock fund, a real estate fund and a T-bill money market fund. The sure return of the T-bill fund is 6%. The expected return and standard deviation for the stock fund and the real estate fund are given in the following table. The correlation between the stock fund and the real estate fund returns is 0.2 (i.e., p=0.2) Risky Assets Stock Fund (S) Real Estate Fund (R) Expected Return 15% 10% Standard Deviation 20% 15% 2) If your client only wants to choose one of the two risky assets (stock fund or real estate fund) to combine with the T-bill fund to form his portfolio, you should suggest the stock fund. Why? 1. Asset Allocation Your client is considering three mutual funds: a stock fund, a real estate fund and a T-bill money market fund. The sure return of the T-bill fund is 6%. The expected return and standard deviation for the stock fund and the real estate fund are given in the following table. The correlation between the stock fund and the real estate fund returns is 0.2 (i.e., p=0.2) Risky Assets Stock Fund (S) Real Estate Fund (R) Expected Return 15% 10% Standard Deviation 20% 15% 2) If your client only wants to choose one of the two risky assets (stock fund or real estate fund) to combine with the T-bill fund to form his portfolio, you should suggest the stock fund. Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts