Question: PLEASE SHOW WORK Clipper Company began operations in January of this year. They produce four products: 81, 82, 83, and 84. A total of $60,000

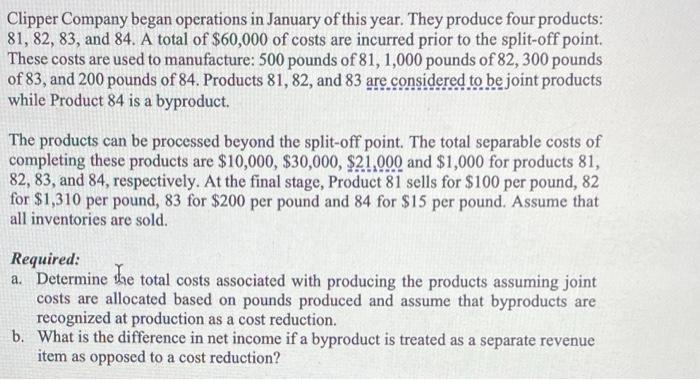

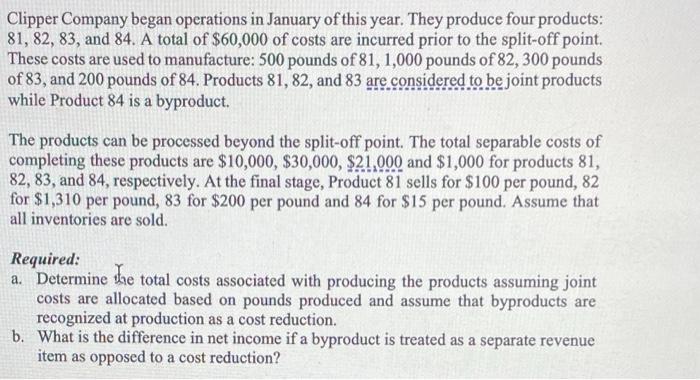

Clipper Company began operations in January of this year. They produce four products: 81, 82, 83, and 84. A total of $60,000 of costs are incurred prior to the split-off point. These costs are used to manufacture: 500 pounds of 81, 1,000 pounds of 82,300 pounds of 83, and 200 pounds of 84. Products 81, 82, and 83 are considered to be joint products while Product 84 is a byproduct. The products can be processed beyond the split-off point. The total separable costs of completing these products are $10,000, $30,000, $21,000 and $1,000 for products 81, 82, 83, and 84, respectively. At the final stage, Product 81 sells for $100 per pound, 82 for $1,310 per pound, 83 for $200 per pound and 84 for $15 per pound. Assume that all inventories are sold. Required: a. Determine the total costs associated with producing the products assuming joint costs are allocated based on pounds produced and assume that byproducts are recognized at production as a cost reduction. b. What is the difference in net income if a byproduct is treated as a separate revenue item as opposed to a cost reduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts