Question: Please show work, trying to completely understand the process. 10.00 points Clifford, Inc., has a target debt-equity ratio of 76. Its WACC is 8.5 percent,

Please show work, trying to completely understand the process.

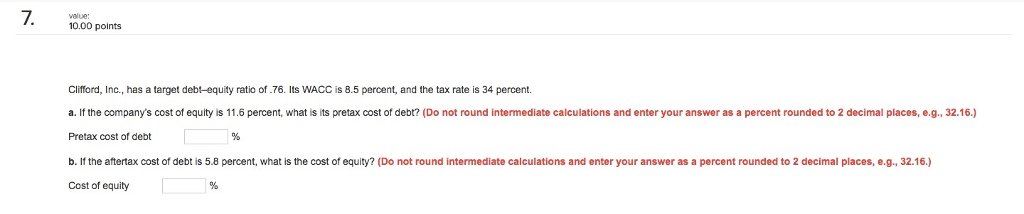

10.00 points Clifford, Inc., has a target debt-equity ratio of 76. Its WACC is 8.5 percent, and the tax rate is 34 percent. a. If the company's cost of equity is 11.6 percent, what is its pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Pretax cost of debt b. If the aftertax cost of debt is 5.8 percent, what is the cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g, 32.16.) Cost of equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock