Question: Please show work. :) Turner Inc. provides a defined benefit pension plan to its employees. The company has 150 employees. The remaining amortiz perlod at

Please show work. :)

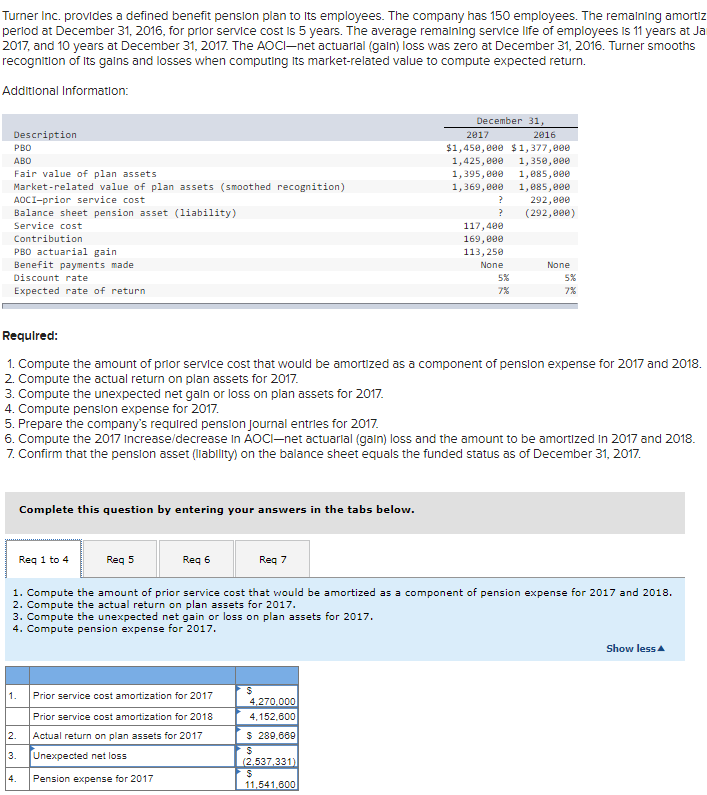

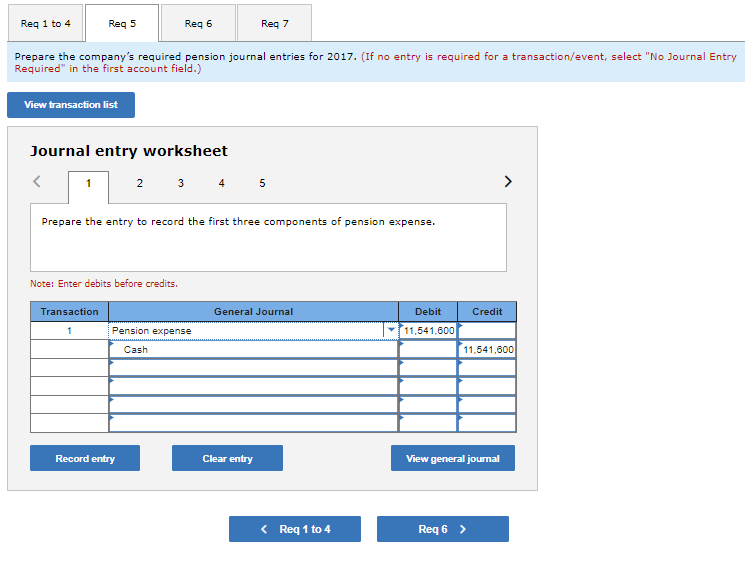

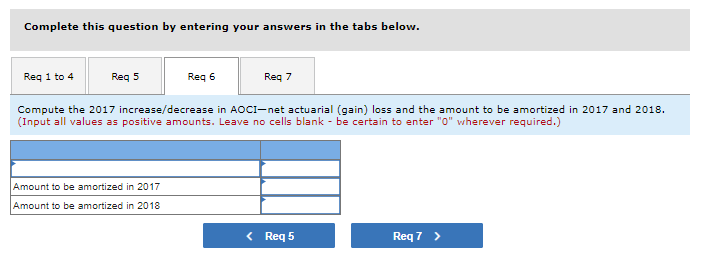

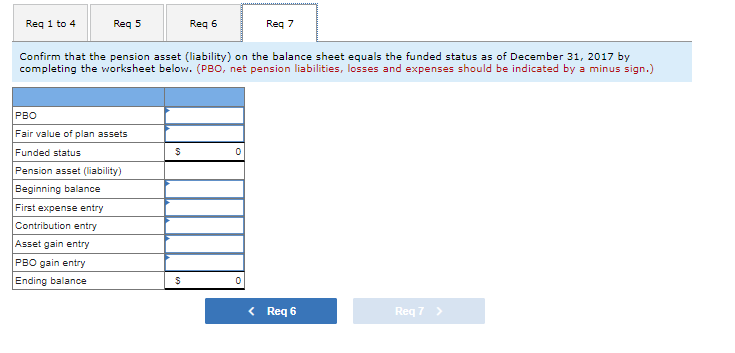

Turner Inc. provides a defined benefit pension plan to its employees. The company has 150 employees. The remaining amortiz perlod at December 31, 2016, for prior service cost is 5 years. The average remaining service life of employees is 11 years at Ja 2017, and 10 years at December 31, 2017. The AOC-net actuarlal (gain) loss was zero at December 31, 2016. Turner smooths recognition of its gains and losses when computing Its market-related value to compute expected return. Additional Information: Description PBO ABO Fair value of plan assets Market-related value of plan assets (smoothed recognition) AOCI-prior service cost Balance sheet pension asset (liability) Service cost Contribution PBO actuarial gain Benefit payments made Discount rate Expected rate of return December 31, 2017 2016 $1,450,000 $1,377,880 1,425,000 1,35e,eee 1,395,880 1,885,000 1,369,880 1,885,000 ? 292,800 ? (292,800) 117,480 169,000 113,250 None None 5% 5% 7% Required: 1. Compute the amount of prior service cost that would be amortized as a component of pension expense for 2017 and 2018. 2. Compute the actual return on plan assets for 2017 3. Compute the unexpected net gain or loss on plan assets for 2017. 4. Compute pension expense for 2017 5. Prepare the company's required pension Journal entries for 2017. 6. Compute the 2017 Increase/decrease in AOCI-net actuarial (gain) loss and the amount to be amortized in 2017 and 2018. 7. Confirm that the pension asset (liability) on the balance sheet equals the funded status as of December 31, 2017. Complete this question by entering your answers in the tabs below. Req 1 to 4 Reg 5 Reg 6 Req 7 1. Compute the amount of prior service cost that would be amortized as a component of pension expense for 2017 and 2018. 2. Compute the actual return on plan assets for 2017. 3. Compute the unexpected net gain or loss on plan assets for 2017. 4. Compute pension expense for 2017. Show less 1. $ 4,270.000 4,152.600 Prior service cost amortization for 2017 Prior service cost amortization for 2018 Actual return on plan assets for 2017 Unexpected net loss 2. 3. $ 289.669 $ (2.537,331) $ 11,541.600 4. Pension expense for 2017 Req 1 to 4 Reg 5 Reg 6 Reg 7 Prepare the company's required pension journal entries for 2017. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 Prepare the entry to record the first three components of pension expense. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Pension expense 11,541.600 Cash 11.541.600 Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Req 1 to 4 Reg 5 Reg 6 Req7 Compute the 2017 increase/decrease in AOCI-net actuarial (gain) loss and the amount to be amortized in 2017 and 2018. (Input all values as positive amounts. Leave no cells blank - be certain to enter "0" wherever required.) Amount to be amortized in 2017 Amount to be amortized in 2018 Reg 1 to 4 Reg 5 Reg 6 Reg 7 Confirm that the pension asset (liability) on the balance sheet equals the funded status as of December 31, 2017 by completing the worksheet below. (PBO, net pension liabilities, losses and expenses should be indicated by a minus sign.) S PBO Fair value of plan assets Funded status Pension asset (liability) Beginning balance First expense entry Contribution entry Asset gain entry PBO gain entry Ending balance s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts