Question: Please Show Work Typed On Computer Not Hand Written. Thank you! Please follow the decimal placing instructions __________________________________________________________________________ These answers are incorrect . Please help!

Please Show Work Typed On Computer Not Hand Written. Thank you!

Please follow the decimal placing instructions

__________________________________________________________________________

These answers are incorrect. Please help!

| S.No | Particulars | Result | |

| 1 | Accounting Rate of Return | 0.19 | % |

| 2 | Pay Back Period | 9.91 | Years |

| 3 | Net Present Value | -153353.36 | |

| 4 | Net Present Value assuming 15% Cost of capital | -187621.01 |

__________________________________________________________________________

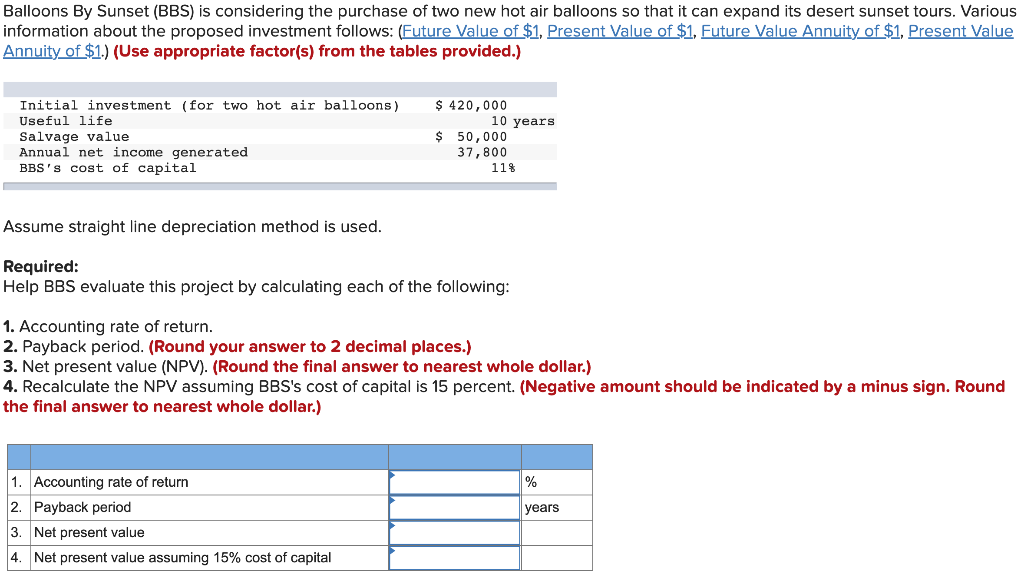

Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided.) Initial investment (for two hot air balloons) Useful life Salvage value Annual net income generated BBS's cost of capital $ 420,000 10 years $ 50,000 37,800 11% Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. (Round your answer to 2 decimal places.) 3. Net present value (NPV). (Round the final answer to nearest whole dollar.) 4. Recalculate the NPV assuming BBS's cost of capital is 15 percent. (Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) % years 1. Accounting rate of return 2. Payback period 3. Net present value 4. Net present value assuming 15% cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts