Question: Please show work using Excel formulas 19 20 Rate 21 22 Q2. What is the net present value of a project that has an initial

Please show work using Excel formulas

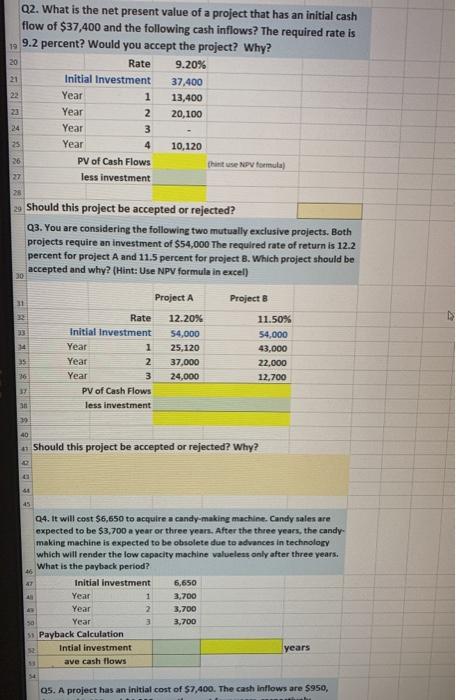

Please show work using Excel formulas19 20 Rate 21 22 Q2. What is the net present value of a project that has an initial cash flow of $37,400 and the following cash inflows? The required rate is 9.2 percent? Would you accept the project? Why? 9.20% Initial Investment 37,400 Year 1 13,400 23 Year 2 20,100 24 Year 3 25 Year 4 10,120 26 PV of Cash Flows (hinte formula 27 less investment 28 2. Should this project be accepted or rejected? Q3. You are considering the following two mutually exclusive projects. Both projects require an investment of $54,000 The required rate of return is 12.2 percent for project A and 11.5 percent for project 8. Which project should be accepted and why? (Hint: Use NPV formula in excel) 10 Project B 31 32 14 Project A Rate 12.20% Initial Investment 54,000 Year 1 25,120 Year 2 37,000 Year 3 24,000 PV of Cash Flows less investment 11.50% 54,000 43,000 22.000 12,700 36 3 19 40 Should this project be accepted or rejected? Why? 41 40 47 Q4. It will cost $6,650 to acquire a candy-making machine. Candy sales are expected to be $3,700 a year or three years. After the three years, the candy making machine is expected to be obsolete due to advances in technology which will render the low capacity machine valueless only after three years. What is the payback period? Initial Investment 6.650 Year 1 3,700 Year 2 3,700 sa Year 3 3.700 Payback Calculation 22 Intial Investment years ave cash flows QS. A project has an initial cost of $7,400. The cash inflows are $950

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts