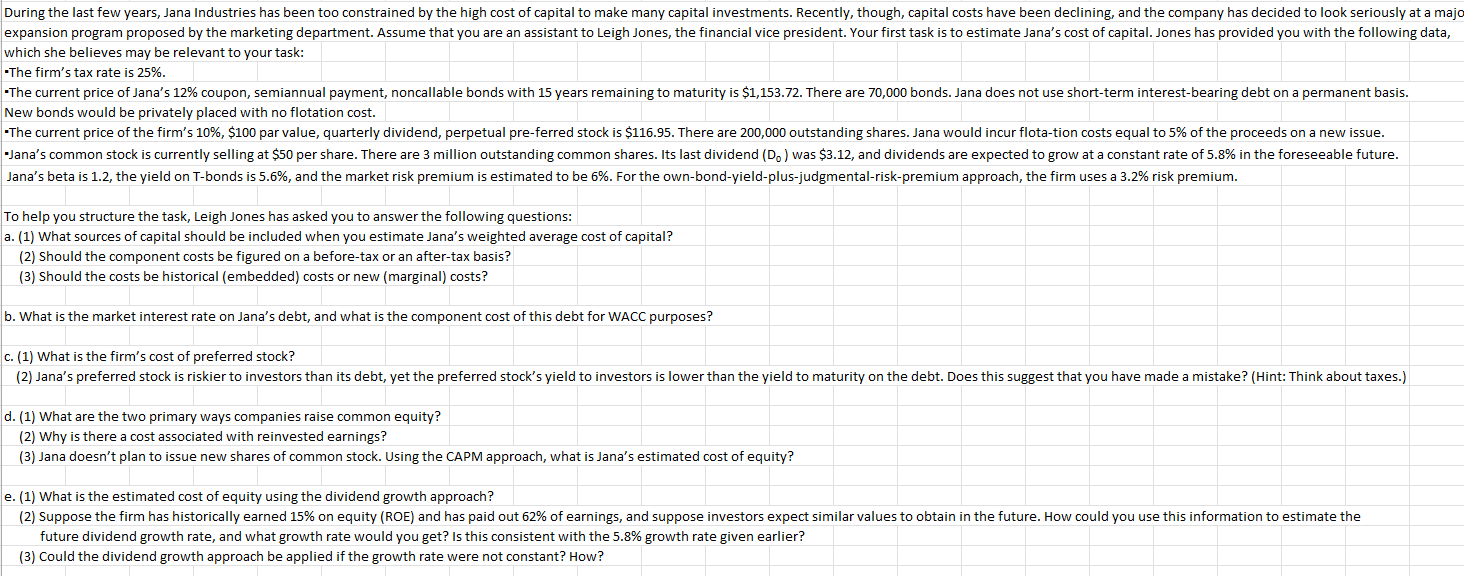

Question: Please show work using Excel. Thanks! which she believes may be relevant to your task: -The firm's tax rate is 25%. New bonds would be

Please show work using Excel. Thanks!

Please show work using Excel. Thanks!

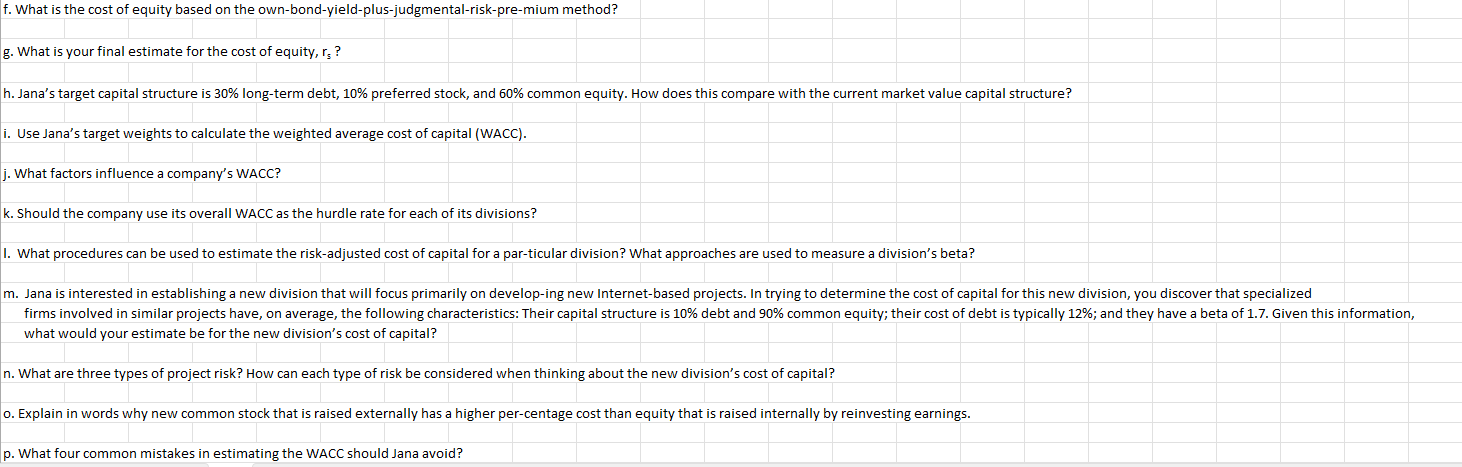

which she believes may be relevant to your task: -The firm's tax rate is 25%. New bonds would be privately placed with no flotation cost. Jana's beta is 1.2 , the yield on T-bonds is 5.6%, and the market risk premium is estimated to be 6%. For the own-bond-yield-plus-judgmental-risk-premium approach, the firm uses a 3.2% risk premium. To help you structure the task, Leigh Jones has asked you to answer the following questions: a. (1) What sources of capital should be included when you estimate Jana's weighted average cost of capital? (2) Should the component costs be figured on a before-tax or an after-tax basis? (3) Should the costs be historical (embedded) costs or new (marginal) costs? b. What is the market interest rate on Jana's debt, and what is the component cost of this debt for WACC purposes? c. (1) What is the firm's cost of preferred stock? d. (1) What are the two primary ways companies raise common equity? (2) Why is there a cost associated with reinvested earnings? (3) Jana doesn't plan to issue new shares of common stock. Using the CAPM approach, what is Jana's estimated cost of equity? e. (1) What is the estimated cost of equity using the dividend growth approach? future dividend growth rate, and what growth rate would you get? Is this consistent with the 5.8% growth rate given earlier? (3) Could the dividend growth approach be applied if the growth rate were not constant? How? f. What is the cost of equity based on the own-bond-yield-plus-judgmental-risk-pre-mium method? g. What is your final estimate for the cost of equity, rs ? h. Jana's target capital structure is 30% long-term debt, 10% preferred stock, and 60% common equity. How does this compare with the current market value capital structure? i. Use Jana's target weights to calculate the weighted average cost of capital (WACC). j. What factors influence a company's WACC? k. Should the company use its overall WACC as the hurdle rate for each of its divisions? I. What procedures can be used to estimate the risk-adjusted cost of capital for a par-ticular division? What approaches are used to measure a division's beta? what would your estimate be for the new division's cost of capital? n. What are three types of project risk? How can each type of risk be considered when thinking about the new division's cost of capital? o. Explain in words why new common stock that is raised externally has a higher per-centage cost than equity that is raised internally by reinvesting earnings. p. What four common mistakes in estimating the WACC should Jana avoid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts