Question: Please show work!!! Will def give thumbs up Let me know if I am missing any information in order to solve this question CSL: 97%

Please show work!!!

Will def give thumbs up

Let me know if I am missing any information in order to solve this question

CSL: 97%

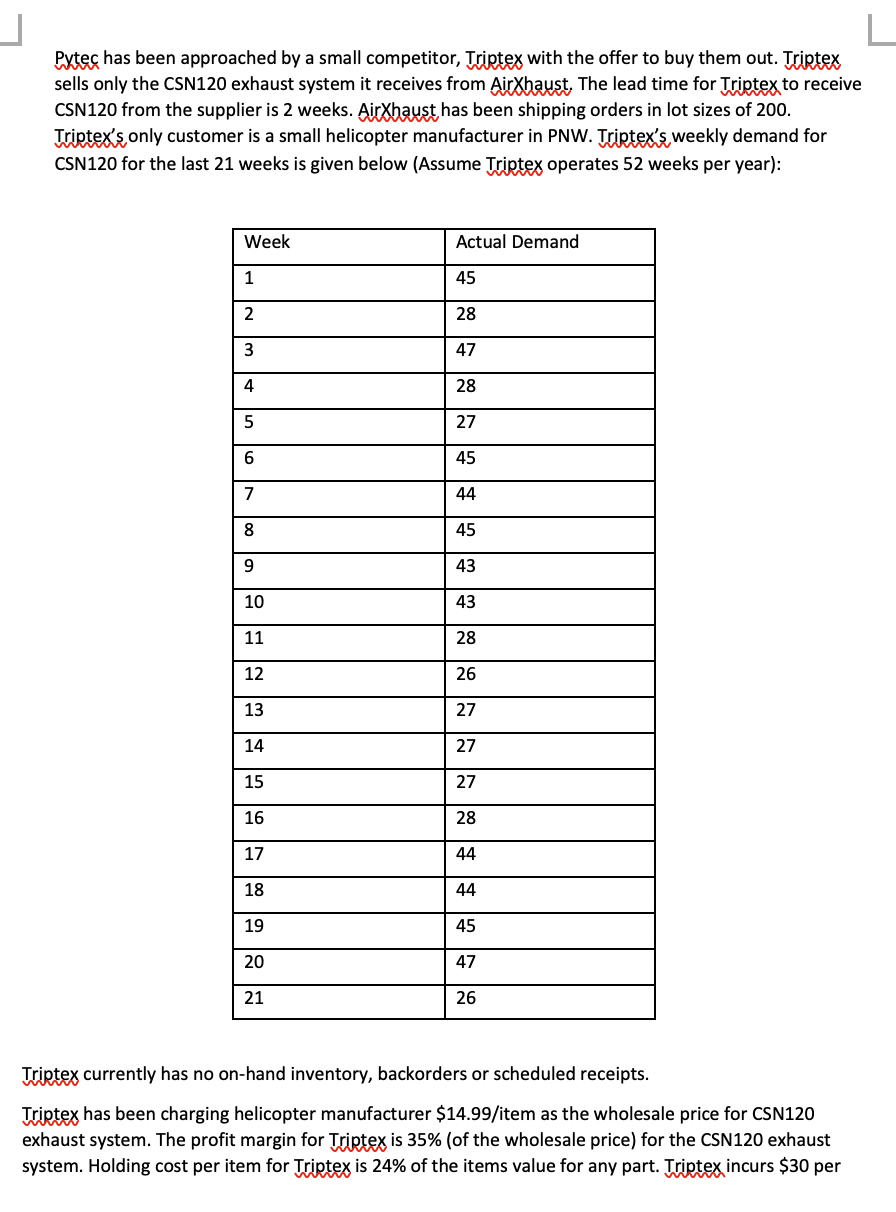

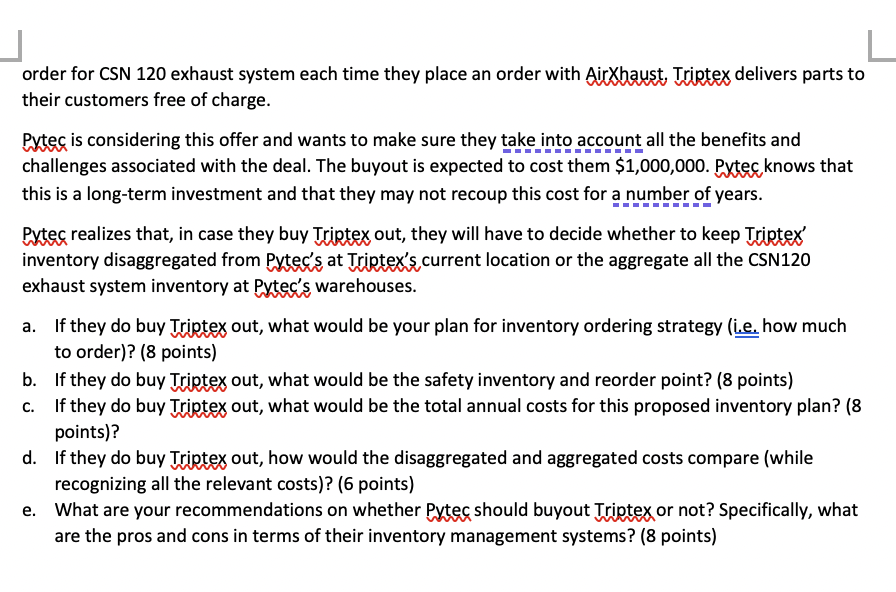

Pxtec has been approached by a small competitor, Triptex with the offer to buy them out. Triptex sells only the CSN120 exhaust system it receives from AirXhaust. The lead time for Triptex to receive CSN120 from the supplier is 2 weeks. AirXhaust has been shipping orders in lot sizes of 200. Triptex's only customer is a small helicopter manufacturer in PNW. Triptex's weekly demand for CSN120 for the last 21 weeks is given below (Assume Triptex operates 52 weeks per year): Week Actual Demand 1 45 2 28 3 47 4 28 5 27 6 45 7 44 8 45 9 43 10 43 11 28 12 26 13 27 14 27 15 27 16 28 17 44 18 44 19 45 20 47 21 26 Triptex currently has no on-hand inventory, backorders or scheduled receipts. Triptex has been charging helicopter manufacturer $14.99/item as the wholesale price for CSN120 exhaust system. The profit margin for Triptex is 35% (of the wholesale price) for the CSN120 exhaust system. Holding cost per item for Triptex is 24% of the items value for any part. Triptex incurs $30 per order for CSN 120 exhaust system each time they place an order with Airxhaust, Triptex delivers parts to their customers free of charge. Pytec is considering this offer and wants to make sure they take into account all the benefits and challenges associated with the deal. The buyout is expected to cost them $1,000,000. Pxtec knows that this is a long-term investment and that they may not recoup this cost for a number of years. Pxtec realizes that, in case they buy Triptex out, they will have to decide whether to keep Triptex inventory disaggregated from Pytec's at Trirtex's current location or the aggregate all the CSN120 exhaust system inventory at Pytec's warehouses. a. If they do buy Triptex out, what would be your plan for inventory ordering strategy (i.e. how much to order)? (8 points) b. If they do buy Triptex out, what would be the safety inventory and reorder point? (8 points) c. If they do buy Triptex out, what would be the total annual costs for this proposed inventory plan? (8 points)? d. If they do buy Triptex out, how would the disaggregated and aggregated costs compare (while recognizing all the relevant costs)? (6 points) e. What are your recommendations on whether Pytec should buyout Triptex or not? Specifically, what are the pros and cons in terms of their inventory management systems? (8 points) Pxtec has been approached by a small competitor, Triptex with the offer to buy them out. Triptex sells only the CSN120 exhaust system it receives from AirXhaust. The lead time for Triptex to receive CSN120 from the supplier is 2 weeks. AirXhaust has been shipping orders in lot sizes of 200. Triptex's only customer is a small helicopter manufacturer in PNW. Triptex's weekly demand for CSN120 for the last 21 weeks is given below (Assume Triptex operates 52 weeks per year): Week Actual Demand 1 45 2 28 3 47 4 28 5 27 6 45 7 44 8 45 9 43 10 43 11 28 12 26 13 27 14 27 15 27 16 28 17 44 18 44 19 45 20 47 21 26 Triptex currently has no on-hand inventory, backorders or scheduled receipts. Triptex has been charging helicopter manufacturer $14.99/item as the wholesale price for CSN120 exhaust system. The profit margin for Triptex is 35% (of the wholesale price) for the CSN120 exhaust system. Holding cost per item for Triptex is 24% of the items value for any part. Triptex incurs $30 per order for CSN 120 exhaust system each time they place an order with Airxhaust, Triptex delivers parts to their customers free of charge. Pytec is considering this offer and wants to make sure they take into account all the benefits and challenges associated with the deal. The buyout is expected to cost them $1,000,000. Pxtec knows that this is a long-term investment and that they may not recoup this cost for a number of years. Pxtec realizes that, in case they buy Triptex out, they will have to decide whether to keep Triptex inventory disaggregated from Pytec's at Trirtex's current location or the aggregate all the CSN120 exhaust system inventory at Pytec's warehouses. a. If they do buy Triptex out, what would be your plan for inventory ordering strategy (i.e. how much to order)? (8 points) b. If they do buy Triptex out, what would be the safety inventory and reorder point? (8 points) c. If they do buy Triptex out, what would be the total annual costs for this proposed inventory plan? (8 points)? d. If they do buy Triptex out, how would the disaggregated and aggregated costs compare (while recognizing all the relevant costs)? (6 points) e. What are your recommendations on whether Pytec should buyout Triptex or not? Specifically, what are the pros and cons in terms of their inventory management systems? (8 points)Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts