Question: please show work with formulas in excel You are considering buying a risky bond. The bond has a $1,000 face value, a 1-year maturity, and

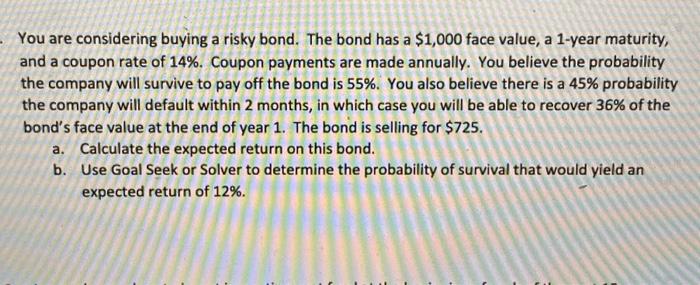

You are considering buying a risky bond. The bond has a $1,000 face value, a 1-year maturity, and a coupon rate of 14%. Coupon payments are made annually. You believe the probability the company will survive to pay off the bond is 55%. You also believe there is a 45% probability the company will default within 2 months, in which case you will be able to recover 36% of the bond's face value at the end of year 1 . The bond is selling for $725. a. Calculate the expected return on this bond. b. Use Goal Seek or Solver to determine the probability of survival that would yield an expected return of 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts