Question: please show work without excel. 6. ABC, Inc. is evaluating its financial performance for the coming year. The firm anticipates that next year's sales will

please show work without excel.

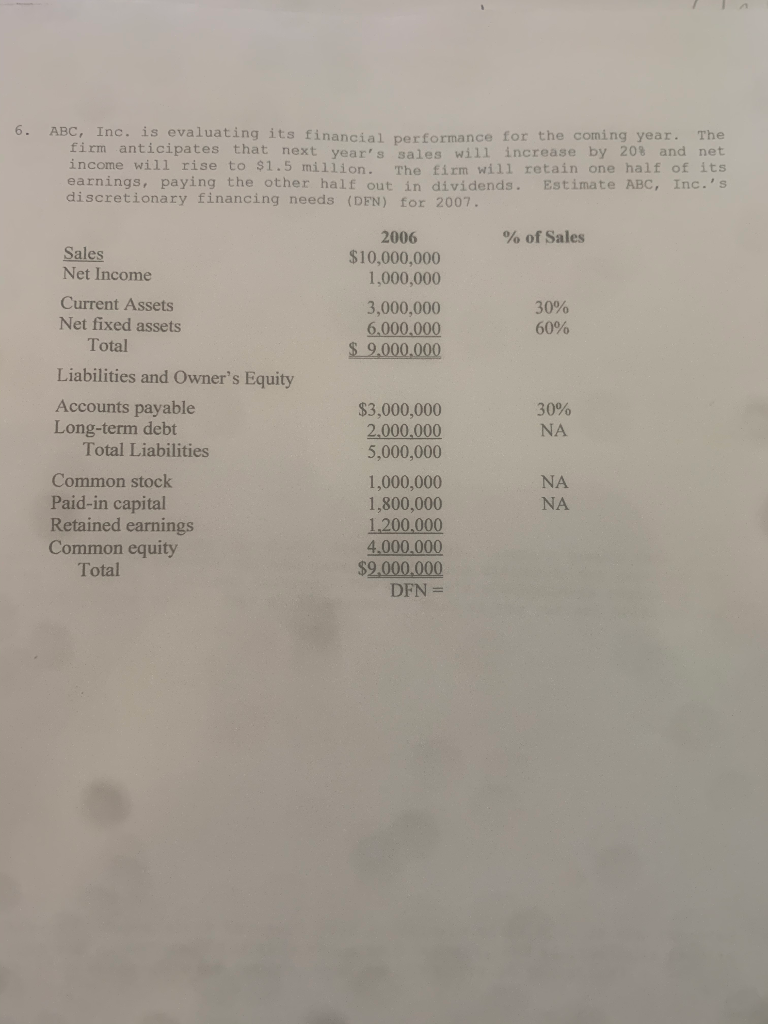

6. ABC, Inc. is evaluating its financial performance for the coming year. The firm anticipates that next year's sales will increase by 208 and net income will rise to $1.5 million. The firm will retain one half of its earnings, paying the other half out in dividends. Estimate ABC, Inc.'s discretionary financing needs (DEN) for 2007. % of Sales 2006 $10,000,000 1.000.000 3,000,000 6,000,000 $ 9.000.000 30% 60% Sales Net Income Current Assets Net fixed assets Total Liabilities and Owner's Equity Accounts payable Long-term debt Total Liabilities Common stock Paid-in capital Retained earnings Common equity Total 30% NA $3,000,000 2,000,000 5,000,000 1,000,000 1.800.000 1.200,000 4.000.000 $9.000.000 DFN = NA 6. ABC, Inc. is evaluating its financial performance for the coming year. The firm anticipates that next year's sales will increase by 208 and net income will rise to $1.5 million. The firm will retain one half of its earnings, paying the other half out in dividends. Estimate ABC, Inc.'s discretionary financing needs (DEN) for 2007. % of Sales 2006 $10,000,000 1.000.000 3,000,000 6,000,000 $ 9.000.000 30% 60% Sales Net Income Current Assets Net fixed assets Total Liabilities and Owner's Equity Accounts payable Long-term debt Total Liabilities Common stock Paid-in capital Retained earnings Common equity Total 30% NA $3,000,000 2,000,000 5,000,000 1,000,000 1.800.000 1.200,000 4.000.000 $9.000.000 DFN = NA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts