Question: Please show work without using Excel A 15 year bond issued today by Carris, Inc. has a coupon rate of 7%, a required return of

Please show work without using Excel

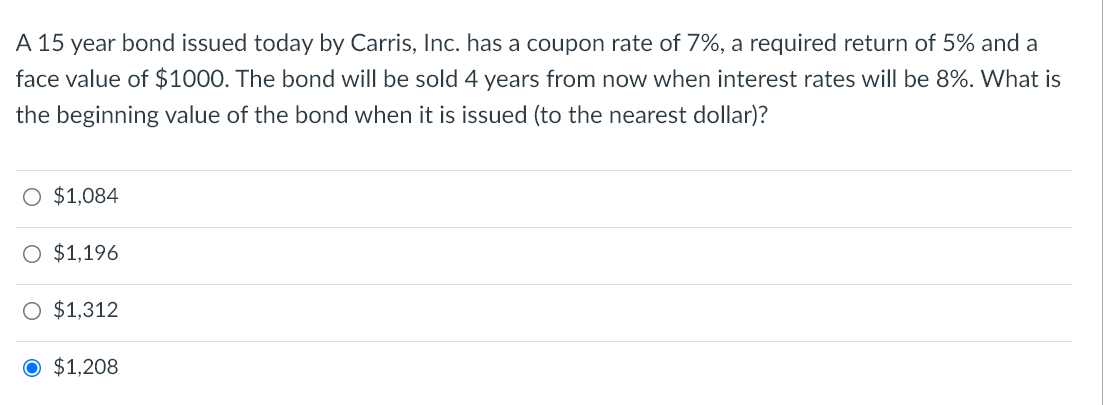

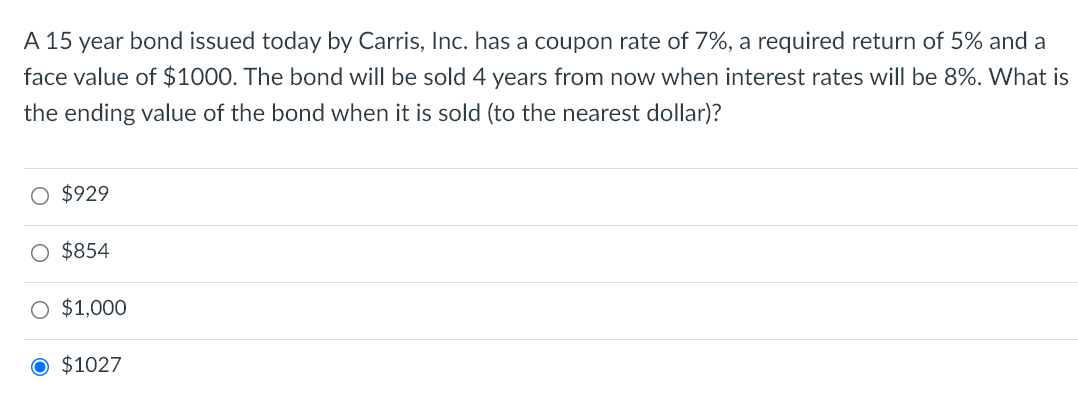

A 15 year bond issued today by Carris, Inc. has a coupon rate of 7%, a required return of 5% and a face value of $1000. The bond will be sold 4 years from now when interest rates will be 8%. What is the beginning value of the bond when it is issued (to the nearest dollar)? O $1,084 O $1,196 $1,312 $1,208 A 15 year bond issued today by Carris, Inc. has a coupon rate of 7%, a required return of 5% and a face value of $1000. The bond will be sold 4 years from now when interest rates will be 8%. What is the ending value of the bond when it is sold (to the nearest dollar)? O $929 O $854 O $1,000 $1027

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts