Question: Please show work- worked out thanks. Please show work to these solutions thanks.. 3-8. PERSONAL TAXES Susan and Stan Britton are a married couple who

Please show work- worked out thanks.

Please show work to these solutions thanks..

3-8. PERSONAL TAXES Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year was $375,000.

- What is their federal tax liability? 83,379

- What is their marginal tax rate? 32%

- What is their average tax rate? 22.23%

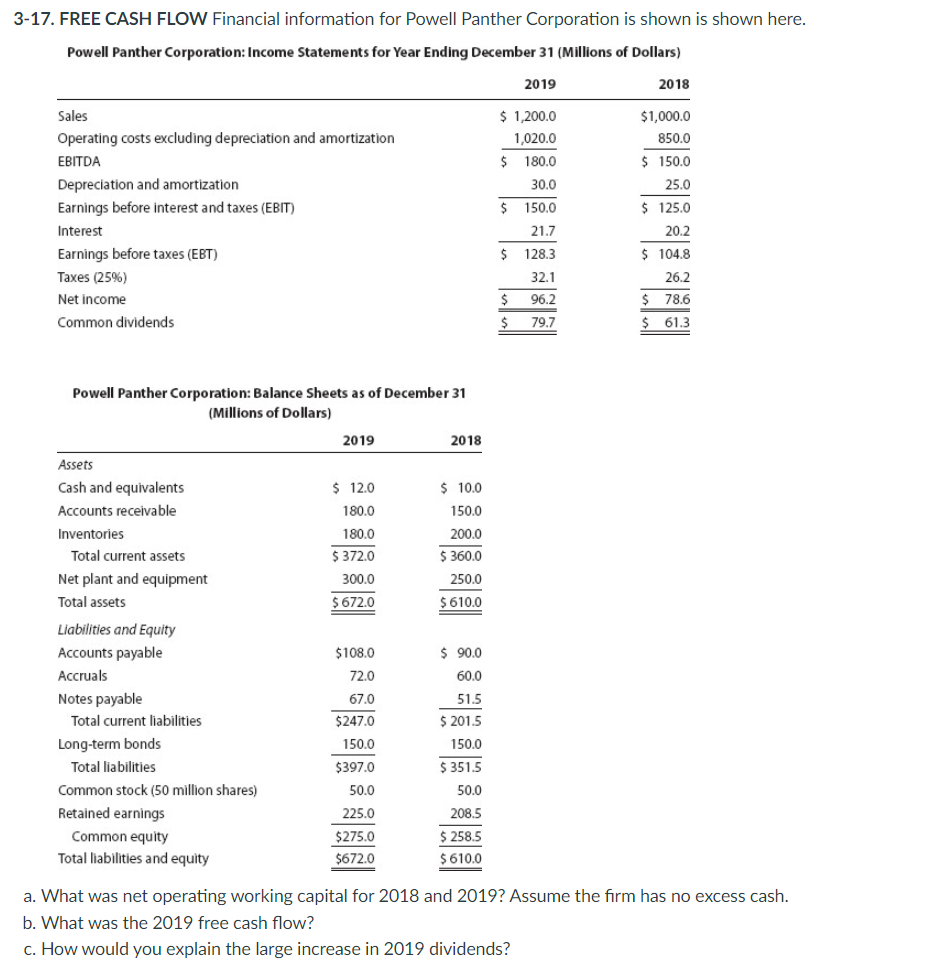

3-17. FREE CASH FLOW Financial information for Powell Panther Corporation is shown is shown here.

A.What was net operating working capital for 2018 and 2019? Assume the firm has no excess cash. NOWc 2018= $210,000,000 NOWc 2019= $192,000,000

B.What was the 2019 free cash flow? 80,500,000 or -18,000,000???

C.How would you explain the large increase in 2019 dividends? ??

4-9. BEP, ROE, AND ROIC Broward Manufacturing recently reported the following information:

| Net income | $615,000 |

| ROA | 10% |

| Interest expense | $202,950 |

| Accounts payable and accruals | $950,000 |

Browards tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC).

BEP=16.63%

ROE=19.71%

ROIC=14.75%

4-18. TIE RATIO MPI Incorporated has $6 billion in assets, and its tax rate is 25%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 6%. What is MPIs times-interest-earned (TIE) ratio?

TIE=3.67x

3-17. FREE CASH FLOW Financial information for Powell Panther Corporation is shown is shown here. Powell Panther Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) Powell Panther Corporation: Balance Sheets as of December 31 (Millions of Dollars) a. What was net operating working capital for 2018 and 2019? Assume the firm has no excess cash. b. What was the 2019 free cash flow? c. How would you explain the large increase in 2019 dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts