Question: please show work You are trying to estimate the incremental after-tax cash flow for an investment analysis for ChemCare, a specialty chemical company. You have

please show work

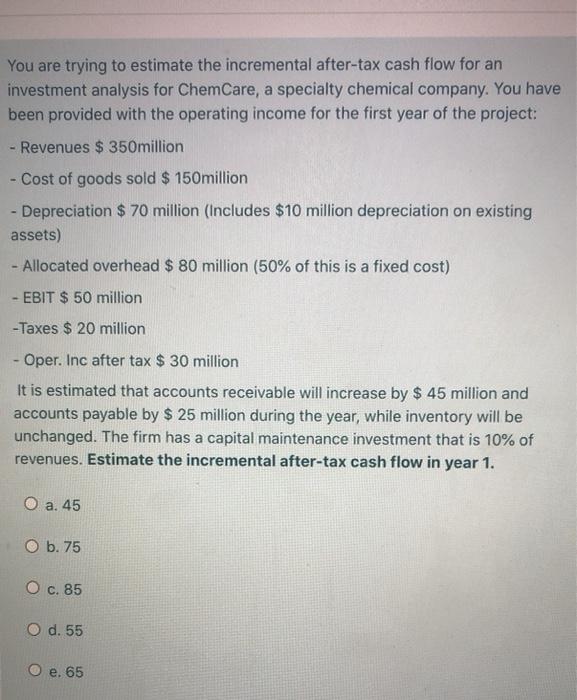

please show work You are trying to estimate the incremental after-tax cash flow for an investment analysis for ChemCare, a specialty chemical company. You have been provided with the operating income for the first year of the project: - Revenues $ 350million - Cost of goods sold $ 150million - Depreciation $ 70 million (Includes $10 million depreciation on existing assets) - Allocated overhead $ 80 million (50% of this is a fixed cost) - EBIT $ 50 million -Taxes $ 20 million - Oper. Inc after tax $ 30 million It is estimated that accounts receivable will increase by $ 45 million and accounts payable by $ 25 million during the year, while inventory will be ur anged. The firm has a capital maintenance investment that is 10% of revenues. Estimate the incremental after-tax cash flow in year 1. O a. 45 O b. 75 O c. 85 O d. 55 O e. 65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts